Weekly Commentary for the week ending April 12, 2025

Key Takeaways

- Equity markets rebounded sharply after a 90-day tariff pause was announced for most countries, except China, easing fears of an all-out trade war.

- Volatility hit historic highs, with the VIX spiking to 52, but history suggests strong forward returns when fear peaks.

- Stocks may be carving out a bottom as valuations reset and worst-case scenarios fade, though uncertainty lingers.

- Investors should stay diversified, focus on quality, and avoid emotional decisions amid ongoing trade and policy swings.

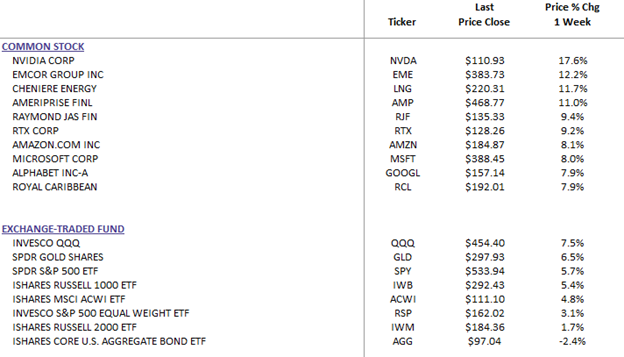

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

Markets Roar Back Amid Tariff Twist

This week, the S&P 500 staged a dramatic comeback, posting its third-largest daily gain since World War II after brushing bear-market territory. The rally followed a White House announcement pausing “reciprocal” tariffs for 90 days at a reduced 10% rate for countries not retaliating to the April 2 tariff hike—except China, where tariffs rose to 145%. China countered with a 125% levy on U.S. imports, but signaled restraint, hinting at de-escalation.

The pivot sparked a 9.5% single-day surge in the S&P 500, pulling major indices back from the brink. Big tech, semiconductors, industrials, and banks led the charge, while energy and homebuilders lagged. Despite the rebound, volatility remains near historic extremes, with the VIX hitting levels unseen since 2020.

What It Means: A Negotiating Window Opens

The tariff pause signals a shift to a more conciliatory U.S. stance, offering a 90-day window for talks with countries like Japan and the EU. While peak trade uncertainty may be behind us, the path forward is bumpy. Elevated tariffs, especially on China, could still raise the average U.S. tariff rate to 20-25% from 2.3%, potentially shaving 2.4% off GDP over two years, per a 2018 Fed model.

Yet, buffers remain. Consumer and corporate balance sheets are solid, and the labor market is softening but not collapsing. Unlike 2008, no major economic imbalances loom. The Fed’s ongoing rate-cutting cycle and cooling inflation (March core CPI at 2.8%) provide further support. If the administration shifts to pro-growth policies, markets could stabilize further.

Volatility’s Silver Lining

The VIX’s spike to 52 marks is only the eighth time in 35 years it’s breached such heights. Historically, when the VIX exceeds 43, the six- and 12-month S&P 500 returns average strong gains, as pessimism gets priced in. Since April 2, daily S&P 500 swings have averaged 7%, far above the norm of 1%.

Valuations also look more attractive. Major indices now trade at or below their 10-year averages, down from stretched levels earlier this year. With stocks pricing in significant economic pain, any sidestep of a deep slowdown could fuel a recovery.

Earnings Season Kicks Off

Q1 earnings began with a bang. JPMorgan (+12.3%), Morgan Stanley (+8.3%), and BlackRock (+6.8%) beat estimates, while Broadcom soared 24.4% on a $10B buyback. But not all shined—WD-40 (-9.4%) and Neogen (-28.5%) missed, slashing guidance. Next week, 33 S&P 500 firms, including Netflix and Goldman Sachs, report, offering clues on corporate health amid trade noise.

Navigating the Storm

While the tariff pause is a step toward de-escalation, clarity is months away. Investors face a mix of hope and hazard as trade talks unfold. Our playbook:

- Stay diversified: Spread risk across sectors and asset classes.

- Prioritize quality: Focus on firms with strong balance sheets.

- Think long-term: Time in the market beats timing the market.

- Avoid knee-jerk moves: Emotional decisions often backfire.

With inflation doubling purchasing power every 25 years, staying invested in growth assets is critical to outpace rising costs.

Looking Ahead

Next week brings March retail sales, housing data, and a wave of earnings. Volatility is likely to linger, but the reset in valuations and signs of trade moderation suggest stocks could find footing. A V-shaped recovery isn’t in the cards, but patient investors may find opportunities in the turbulence.