Weekly Commentary for the week ending December 6, 2024

As the calendar turns toward the year-end, optimism is in the air, buoyed by a mix of robust economic data and resilient financial markets. Investors have plenty to celebrate, with equity markets continuing their climb to record highs and bond markets offering yields that remain attractive. Beneath this market strength lies the cornerstone of today’s confidence: an economy that continues to expand at or above trend, with no imminent signs of recession clouding the horizon.

Economic Data Signals Resilience

This past week’s data reinforced the narrative of a steadfast U.S. economy. The ISM manufacturing and services PMI new orders components—a reliable leading indicator of economic momentum—remained in expansion territory for November. This resilience underscores the strength in economic activity and suggests continued growth into 2024.

The labor market also delivered reassuring news. Employers added 227,000 jobs in November, surpassing expectations of 220,000, while October’s previously weaker data saw an upward revision. Although the unemployment rate edged up slightly to 4.2%, it remains significantly below the historical average of 5.7%. This slight increase in unemployment may reflect a healthy rebalancing as more individuals return to the workforce.

The Elusive Soft Landing Within Reach

The backdrop for financial markets remains firmly intact as the U.S. economy appears poised to achieve a “soft landing.” This scenario—a modest slowdown in growth that avoids a recession—has long been a desired but challenging economic outcome. As we transition into 2025, consumer spending is likely to remain a pillar of support, driven by favorable tailwinds such as easing interest rates and wage growth outpacing inflation.

Despite pockets of policy uncertainty and the inevitable bouts of market volatility, these developments bolster confidence in the broader economic picture. For investors, pullbacks in the market may present opportunities rather than cause for alarm, given the economy's resilience and the lack of a downturn in sight.

A Year of Strength Sets the Tone for 2024

The broader narrative for 2024 continues to be one of economic strength. Since 2020, U.S. GDP growth has exceeded long-term trends, and the current year has upheld that trajectory. Quarterly annualized growth rates for 2024 have averaged 2.5%, with the fourth quarter poised to surpass this mark. The Federal Reserve’s GDP-Now model forecasts a robust 3.3% annualized growth rate for the fourth quarter, its highest projection since the quarter began.

Tech Strength Lifts Equities Amid Mixed Sector Performance

This week, U.S. equities delivered a mixed performance with notable strength in technology leading the charge. The S&P 500 and Nasdaq both achieved fresh record highs, with the Nasdaq emerging as the week’s top-performing index, fueled by gains in Big Tech. The cap-weighted S&P 500 outperformed its equal-weighted counterpart (RSP) by approximately 230 basis points, marking the largest spread since July.

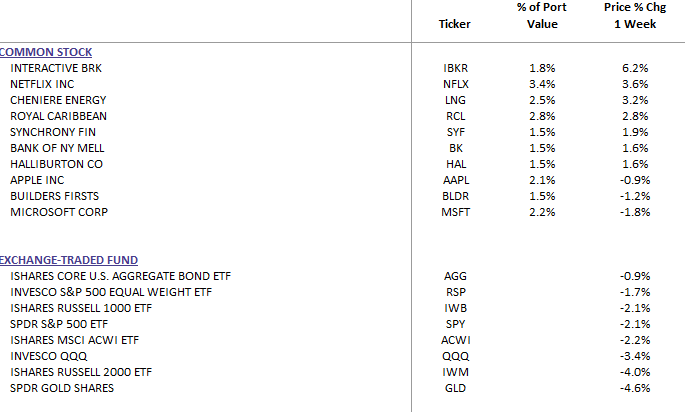

WealthTrust Long Term Growth Portfolio Weekly Top 10

Sector Highlights: Winners and Losers

Outperforming sectors included semiconductors, software, electric vehicles (EVs), athletic apparel, airlines, cruise lines, and entertainment. On the flip side, underperformers featured industrial metals, logistics, road and rail, homebuilders, energy, banks, credit cards, telecom, and food and beverage sectors.

In the broader market:

- Treasuries saw mild gains with curve steepening.

- The U.S. Dollar Index rose 0.3%.

- Gold declined 0.8%.

- Bitcoin futures surged 3.9%, hitting a new record high above $100K.

- WTI crude oil fell 1.2%.

Key Market Driver Tech Leadership and AI Momentum

Tech stocks rebounded sharply after a rotational drag in November. This was propelled by strong earnings reports, including:

- Salesforce (CRM): +9.7%

- Marvell Technology (MRVL): +22.5%

- HP Enterprise (HPE): +12.9%

Positive AI developments from the Amazon AWS conference added to the sector’s strength. The tech rally reinforced broader market resilience, supported by encouraging consumer spending data.

Consumer Resilience

Spending commentary from Visa and Mastercard highlighted the health of the U.S. consumer. Mastercard reported total Black Friday retail sales up 3.4% year-over-year, while standout earnings included:

- Lululemon (LULU): +24.6%

- Kroger (KR): -3%

Economic Data Supports Optimism

The macro backdrop received a boost from:

- November Payrolls: 227K (above consensus 200K), though prior-month revisions and participation rate trends raised some concerns.

- ISM Manufacturing: 48.4, the highest since April and the best month-over-month improvement since August.

- JOLTS Job Openings: 7.744M, exceeding expectations.

Mixed signals in economic data were evident, with ISM Services falling to a three-month low of 52.1, below consensus.

Market Sentiment and Positioning

Investor sentiment reflected cautious optimism, with notable inflows into U.S. equities. Key observations:

- S&P Futures: Goldman Sachs reported the largest three-month inflows since 2021.

- Market Concentration: BofA noted S&P 500 market cap concentration surpassing even the 1990s tech bubble levels.

However, concerns around extended positioning, declining participation rates, and policy uncertainty (e.g., Trump’s tariff and border security priorities) added to bearish narratives.

Corporate Updates

Earnings and corporate announcements were mixed:

- Enterprise Software Strength: Solid performance from Salesforce and HPE.

- Consumer Trends: Positive updates from Lululemon (+24.6%) and Ulta (+10.7%).

- Intel (INTC): -13% after CEO Gelsinger announced his retirement.

- Super Micro Computer (SMCI): +34.6%, following a clean financial investigation report.

Key sector news included the tragic death of UnitedHealthcare's segment CEO and American Airlines (AAL): +19.8% on positive Q4 trends.

Looking Ahead: Quiet Week Expected

The upcoming week is expected to be relatively subdued ahead of the December FOMC meeting on the 18th. Highlights include:

- November CPI: Scheduled for 11-Dec, with core CPI expected to remain at 0.3% month-over-month and 3.3% year-over-year.

Treasury Auctions: $72B in 3-year notes (Tuesday), $52B in 10-year notes (Wednesday), and $31B in 30-year bonds (Thursday).

S&P 500 Sector Performance

This week’s sector performance saw Consumer Discretionary (+5.85%), Communication Services (+4.11%), and Technology (+3.35%) leading the pack. Lagging sectors included Energy (-4.55%), Utilities (-3.84%), and Materials (-3.04%).

As we close the books on 2024, the U.S. economy stands as a testament to resilience and adaptability. While potential headwinds—ranging from geopolitical tensions to shifts in fiscal or monetary policy—may test investor resolve, the current fundamentals suggest a strong foundation for continued growth. With the holiday season upon us and the promise of another year ahead, both markets and the broader economy appear set to cap 2024 on a high note. The path forward may not be entirely smooth, but it remains well-lit with opportunity.