Weekly Commentary for the week ending February 15, 2025

The Reality of the Stock Market:

The market is off to a complex start in 2025, with headlines often telling one story while market fundamentals reveal another. Let’s break down the key dynamics at play.

Inflation made headlines in January with a hotter-than-expected CPI report, rising 0.5% from the prior month. Food and energy costs surged, and core inflation has remained stuck at 3.3% for the past eight months. But does this signal a return to post-pandemic inflation levels? Likely not. Some of these price spikes, like energy and food, may be one-offs. Still, the Fed is in no rush to cut rates, likely delaying its first move to the second half of the year.

Meanwhile, market leadership is shifting. Tech’s dominance is being challenged as earnings growth outside the Magnificent 7 gains momentum. European equities, despite uncertainty around trade policies, are outperforming—going against the doom-and-gloom headlines although we are not convinced to deploy asset allocations to this market.

For investors, this means navigating market pullbacks wisely. Opportunities exist in cyclical, and value stocks while rising Treasury yields could be an opening to lock in attractive returns.

The takeaway? Inflation remains sticky, but a repeat of post-pandemic highs is unlikely. Fundamentals are strong, and market resilience continues—even when the headlines suggest otherwise.

US Weekly Market Recap: Stocks Rebound Amid AI Optimism and Tariff Uncertainty

The major U.S. equity indices rebounded this week, recovering some of last week's modest losses. The Nasdaq led the way, gaining 2.58%, driven by strength in Big Tech, while the S&P 500 rose 1.47%. The Dow climbed 0.55%, and the Russell 2000 ended nearly flat at +0.01%, reflecting weaker breadth across smaller-cap names.

Market Overview

Tech stocks propelled gains, with Nvidia (+6.9%) and Apple (+7.5%) posting significant advances. Semiconductor stocks (SOX +3.0%), China tech, steel (CLF +14.3%), aluminum, casinos, railways, refiners, grocers, waste, and homebuilders were among the strongest groups. Conversely, managed care, pharmaceuticals, aerospace & defense, engineering & construction, airlines, trucking, regional banks, P&C insurance, credit cards, hotels, and casual diners lagged.

Treasuries were firmer, leading to a steepening yield curve. The U.S. dollar index declined 1.2%, though it strengthened against the yen. Gold climbed 0.5% to a record above $2,900/oz. Oil dipped slightly, with WTI crude settling down 0.3% amid speculation that a potential Russia-Ukraine truce could ease sanctions on Russian oil.

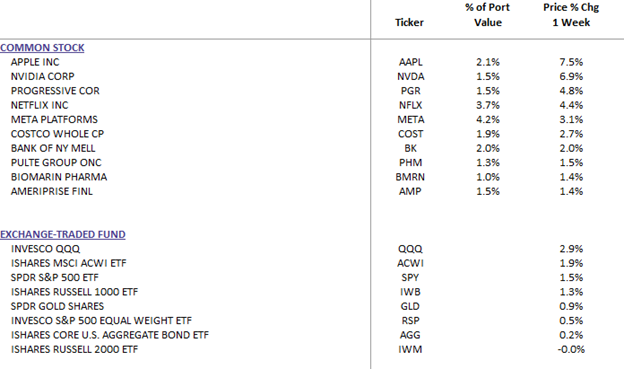

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

What Drove the Market This Week?

Markets were buoyed by a combination of AI-related optimism, cooling rate concerns, broader earnings strength, hedge fund buying, and geopolitical developments. Key AI-related moves, including an Apple-Alibaba partnership and a Dell-xAI server deal, drove investor sentiment.

Geopolitical shifts also played a role. Reports suggested a possible Ukraine War truce, with Trump and Putin set to speak. Meanwhile, Trump’s announcement of reciprocal tariffs created market uncertainty, though investors took comfort in the potential for negotiation and phased implementation. However, tariff-related mentions in earnings calls hit their highest level since Q2 2019, underscoring the lingering uncertainty of a Trump 2.0 economic landscape.

Inflation concerns remained a headwind. January’s core CPI came in hotter than expected, driven by shelter costs (+0.4%), airline fares, food, car insurance, and energy prices. Core goods inflation hit a two-year high, with analysts citing seasonal distortions. Rate cut expectations shifted further out, with markets now pricing in just 1-2 cuts for the year. Additionally, January retail sales fell below expectations—its first decline since August 2024—though December’s data was revised higher. Cold weather was blamed for weaker auto sales and building materials demand. Meanwhile, jobless claims remained low, signaling continued labor market resilience.

Fed Chair Jerome Powell’s testimony before the Senate Banking Committee offered no major surprises. Powell acknowledged inflation remains a challenge and emphasized the Fed’s independence from political influence. Other Fed officials echoed a cautious stance, suggesting rates may stay elevated longer than markets had hoped.

Earnings Highlights: Strong Reports Offset By Pockets of Weakness

Q4 earnings season remains upbeat, with 76% of S&P 500 companies reporting positive EPS surprises and 62% beating revenue expectations. The S&P 500’s year-over-year earnings growth rate has climbed to 16.9% from 16.4% last week.

Standout Reports:

- McDonald’s (MCD) +4.8%: Strong comps driven by guest count growth.

- Coca-Cola (KO) +7.9%: Organic growth beat by 700bps.

- Shopify (SHOP) +9.3%: Beat expectations with positive guidance.

- CVS Health (CVS) +21.8%: Strong Q4 results lifted shares.

- DuPont (DD) +9.8%: Strength in electronics segment.

- Gilead Sciences (GILD) +8.4%: HIV franchise drove earnings beat.

- Airbnb (ABNB) +19.6%: Key growth metrics exceeded expectations.

- DraftKings (DKNG) +26.5%: Raised FY25 revenue guidance.

- Intel (INTC) +25.5%: Helped by U.S. AI chip investment outlook.

Notable Laggards:

- Humana (HUM) -7.5%: Missed estimates and guided below for 2025.

- Lyft (LYFT) -5.2%: Pricing pressures weighed on bookings.

- Applied Materials (AMAT) -6.0%: Guidance impacted by export control concerns.

- Reddit (RDDT) -12.8%: Strong report but high expectations led to selloff.

- Trade Desk (TTD) -31.6%: First earnings miss in over 30 quarters.

- Datadog (DDOG) -8.1%: Beat estimates but lowered forward guidance.

Outside earnings, Apple (+7.5%) announced an AI partnership with Alibaba (+20.5%) for iPhones in China. JPMorgan’s (+0.3%) COO forecasted strong Q1 trading revenue and investment banking fees. T-Mobile (+9.9%) revealed plans to launch Starlink-powered satellite-to-cell service in July. Meanwhile, Elliott Management reportedly took a stake in BP (+8.5%), boosting shares.

Looking Ahead: Earnings and Economic Data in Focus

Notable earnings next week:

- Tuesday: GPC, MDT, ANET, BMBL, OXY

- Wednesday: CRL, GRMN, WING, BHC, CVNA

- Thursday: BLDR, WMT, W, BKNG, TXRH

- Friday: CEG

Key macroeconomic events:

- Tuesday: February Empire State Index

- Wednesday: January Building Permits, Housing Starts, FOMC Minutes

- Thursday: Jobless Claims, February Philly Fed Index

- Friday: February PMI Manufacturing & Services, January Existing Home Sales, Michigan Sentiment

In Summary: While markets climbed this week, uncertainty remains. Inflation’s persistence has pushed back rate-cut expectations, while tariff-related concerns could continue to weigh on sentiment. AI and earnings strength provided support, but a cautious Fed and geopolitical risks warrant vigilance. As we navigate these dynamics, a balanced, disciplined investment approach remains key to long-term success.

With this in mind, we are maintaining a cautious approach by adding to our cash and short-term treasury positions looking for pullback opportunities going forward.