Weekly Commentary for the week ending February 8, 2025

Overall Market Commentary

U.S. Economy Remains on Track for Growth

The U.S. economy has started 2025 on solid footing, with strong fundamentals supporting momentum despite trade policy uncertainties. Following 2.8% full-year growth in 2024, first-quarter GDP is on track for 2.9% growth, exceeding the 1.5%-2.0% trend.

Consumer spending, comprising 68% of GDP, remains a key driver. Fourth-quarter consumption grew 4.2%, the highest in 2024, surpassing the 3% long-term average. Additionally, manufacturing shows signs of recovery, with the U.S. manufacturing PMI returning to expansion for the first time since 2022.

Corporate Earnings Growth Continues

Earnings remain strong, with 2025 growth projected at 10%-15%, the highest since 2021. Both growth and value sectors are contributing, supporting broader market leadership.

Thus far, 62% of S&P 500 companies have reported fourth-quarter earnings, with 77% exceeding expectations, aligning with the five-year average. Looking ahead, corporate tax policy and deregulation could influence sentiment and market performance.

Labor Market Strength Supports Households

The latest jobs report highlights labor market resilience, a pillar of economic stability. January saw 143,000 jobs added, slightly below expectations, but revisions lifted the three-month average to 241,000, above the 12-month average of 165,000. The unemployment rate dipped to 4.0%, remaining well below the long-term average of 5.7%.

Wage growth rose to 4.1% year-over-year, surpassing expectations. While higher wages may contribute to inflationary pressure, they also support consumer confidence. Since mid-2023, real wages have outpaced inflation, reinforcing purchasing power.

With sustained growth, strong earnings, and a resilient labor market, economic and market prospects remain positive for 2025.

A Tough Week for Equities

Major U.S. equity indices faced headwinds this past week, with the S&P 500, Nasdaq, and Russell 2000 all closing lower for the second consecutive week. Market weakness was led by a broad selloff in big tech, where Alphabet (GOOGL) fell 9.2% and Amazon (AMZN) dropped 3.6% following earnings results. Other laggards included auto manufacturers, apparel brands, homebuilders, asset managers, and industrial suppliers. However, some segments of the market showed resilience—staples retailers, cybersecurity, industrial metals, and pharmaceutical stocks posted gains, demonstrating the continued sectoral rotation at play.

Treasury markets reflected a mix of sentiments, with the 10-year yield closing around 4.50% after briefly dipping to 4.40% midweek. The quarterly refunding announcement did not alter auction sizes, though expectations are building for an increase, possibly in November. Meanwhile, the dollar was weaker against the yen but stronger against the euro, with the DXY index logging its third decline in four weeks. Notably, gold reached a record high, rising 1.9% for the week, continuing its six-week winning streak. Oil prices, however, softened, with WTI crude declining 2.1%.

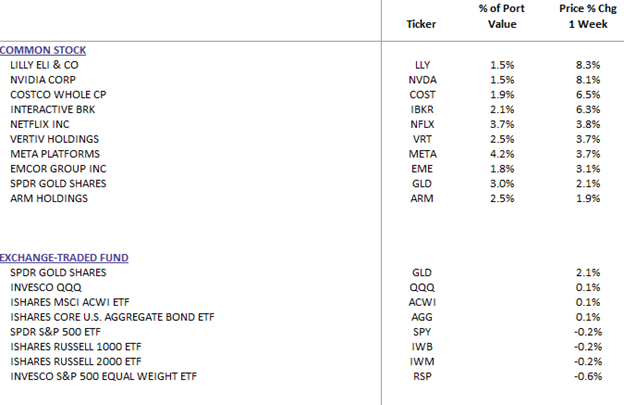

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

Macroeconomic and Trade Developments

The market was also rattled by trade tensions after President Trump implemented new tariffs—25% on Canada and Mexico, and 10% on China. Canada and Mexico quickly secured one-month reprieves by agreeing to additional border-security measures, but China's tariffs remain in place, with further retaliation likely. The European Union is actively working to avoid becoming the next trade-war casualty by negotiating possible tariff reductions on U.S. auto imports. Meanwhile, President Trump’s announcement of "reciprocal tariffs" on additional countries has created additional uncertainty.

From an economic data perspective, U.S. payrolls data fell short of expectations at 143K versus the 170K forecast, though prior months saw upward revisions of 100K. Wage inflation surprised to the upside, with average hourly earnings rising 0.5% month-over-month, above the 0.3% expectation. The consumer sentiment index weakened for the second straight month, while inflation expectations jumped from 3.3% to 4.3%. On the manufacturing side, ISM data reflected strength, with new orders expanding for the third month in a row, but ISM Services disappointed as new orders fell to their lowest level since June. Jobless claims ticked higher, though still remain at historically low levels.

Earnings Season

With 62% of S&P 500 companies having reported, Q4 earnings results have exceeded expectations. The blended earnings growth rate for the index currently stands at 16.4%, well above the initial forecast of 11.8% at the end of the quarter. Despite these strong results, revenue beats have been below the five-year average, and companies reporting positive surprises are seeing less upside in their stock prices than in previous quarters. This bolds well for future price increases.

Some notable earnings movers included:

- Amazon (-3.6%): Posted solid margins, but Q1 guidance flagged FX headwinds.

- Alphabet (-9.2%): Strong Search and YouTube results, but concerns over slowing Cloud growth and $75B in planned CapEx weighed on sentiment.

- Palantir (+34.4%): Strong U.S. government business momentum propelled shares higher.

- Uber (+11.6%): Beat expectations on both Mobility and Delivery, while Bill Ackman disclosed a position.

- Spotify (+13.6%): Outperformed on user growth and profitability metrics.

- Philip Morris (+10.9%): Strong pricing and volume mix led to a positive surprise.

- AMD (-7.2%): Client and Gaming segments performed well, but Data Center softness raised concerns.

As we move further into earnings season, key reports from companies like Coca-Cola (KO), Cisco (CSCO), McDonald’s (MCD), and Deere (DE) will provide further insight into consumer trends and industrial demand.

Key Market Catalysts Next Week

Investors should brace for another busy week with major economic reports and Fed commentary. The January Consumer Price Index (CPI) report on Wednesday and Producer Price Index (PPI) on Thursday will be closely monitored for signs of inflationary trends. Retail sales data on Friday will provide further clarity on consumer spending patterns.

Fed Chair Jerome Powell’s semiannual monetary policy testimony before Congress on Tuesday and Wednesday will also be pivotal. With current futures markets pricing in only one 25-basis-point rate cut in June or July, Powell’s comments on inflation progress and economic conditions could sway expectations.

In the geopolitical sphere, the Munich Security Conference (Feb 14-16) may garner headlines, especially if President Trump outlines his approach to ending the Ukraine conflict.

Sector Performance and Market Trends

Sector performance was mixed this week, with some defensive areas holding up while cyclicals struggled:

- Outperformers: Consumer Staples (+1.55%), Real Estate (+1.26%), Energy (+0.99%), Technology (+0.83%), Financials (+0.61%), Utilities (+0.24%)

- Underperformers: Consumer Discretionary (-3.58%), Communication Services (-2.12%), Industrials (-0.80%), Materials (-0.56%), Healthcare (-0.31%)

Given the current economic backdrop, market participants continue to track companies with strong earnings performance, stable cash flows, and the ability to navigate ongoing inflationary pressures. Additionally, defensive growth sectors such as healthcare, consumer staples, and cybersecurity remain areas of focus, while industrials and financials are being monitored closely for their response to the interest rate environment.

Adapting to Market Shifts

Markets remain in flux, with crosscurrents from trade policy, inflation, and monetary policy all playing a role in near-term price action. While earnings strength provides a positive backdrop, the path of interest rates, the pace of economic growth, and geopolitical developments will shape sentiment in the weeks ahead.

A focus on fundamentals, market trends, and macroeconomic signals remains essential. We will continue monitoring key developments as they unfold.