Weekly Commentary for the week ending January 25, 2025

Post-Inauguration Commentary:

President Trump’s administration began with a record-breaking 26 executive orders on his first day, focusing on energy, immigration, tariffs, and technology. While the initial policies were more measured than anticipated, providing relief to markets, investors should brace for potential volatility as further updates are announced.

Despite policy uncertainties, the market remains supported by a strong economic backdrop, including a resilient consumer and robust earnings growth. As 2025 unfolds, these fundamentals could help offset volatility and even improve as some uncertainties are resolved.

Market Overview

Major U.S. equity indices closed higher for a second consecutive week, led by strong gains in big tech. Netflix (NFLX) emerged as the week’s top performer, surging 13.9% after robust Q4 results, while Apple (AAPL) lagged with a 3.1% decline.

Notable outperforming sectors included telecoms, software, investment banks, and industrials like railways and machinery. In contrast, energy, beverages, and semiconductors saw underperformance, with energy stocks reflecting weakness in crude oil prices, which fell 3.5% over the week.

Treasury markets firmed, signaling investor caution amid a weaker dollar, which lost ground against the euro and sterling. Bitcoin futures rose 1.3%, and gold climbed 1.2%, underscoring some investor movement toward alternative assets.

Key Market Drivers

This week’s gains were driven by multiple factors, including:

- Earnings Momentum: The Q4 earnings season started strong, with 80% of S&P 500 companies reporting EPS above estimates. NFLX shattered expectations, while Oracle (ORCL) gained 14.0% following its AI-focused "Stargate" announcement.

- Policy Developments: Optimism surrounding President Trump’s policies provided tailwinds. While concerns remain about potential tariffs on Mexico and Canada, softer-than-expected rhetoric on China helped buoy sentiment.

- Macroeconomic Indicators: Positive surprises in the January manufacturing PMI and better-than-expected December home sales supported investor confidence.However, mixed data, including weaker services PMI and elevated jobless claims, highlighted lingering economic uncertainty.

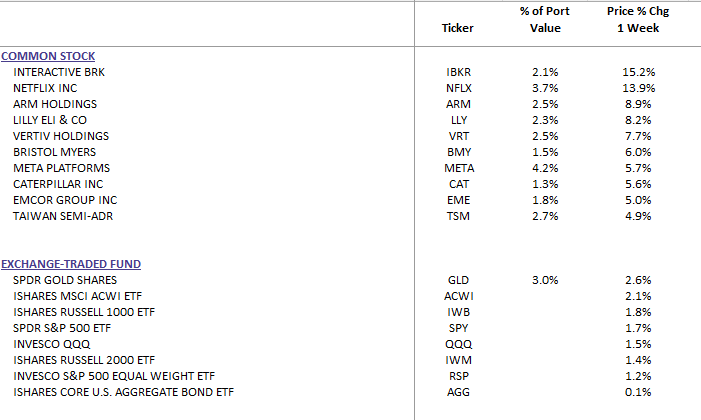

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

Sector Performance

Winners:

Communication Services: +4.01%, led by Netflix and telecom gains.

Healthcare: +2.90%, driven by robust earnings and positive GLP-1 trial results from Novo Nordisk (NVO).

Industrials: +2.40%, bolstered by cost controls in railway companies and upbeat guidance from industrial players.

Losers:

Energy: -2.90%, reflecting WTI crude’s 3.5% decline.

Materials: +0.74%, hindered by weakness in industrial metals and marine shipping.

Earnings Highlights

Notable earnings this week reinforced sectoral strengths and weaknesses:

- Beats: Netflix (+13.9%) crushed expectations with record subscriber growth. Twilio (+21.1%) soared on a strong Q4 preannouncement.

- Misses: Halliburton (-7.0%) faced pressure from weaker North American results, while EA (-17.9%) cut guidance on a slowdown in Global Football.

Upcoming earnings next week feature tech heavyweights Microsoft (MSFT), Meta (META), and Tesla (TSLA), alongside industrial stalwarts Boeing (BA) and Caterpillar (CAT). These reports could shape sentiment across key sectors.

What’s Next for Investors?

Looking ahead, market participants will closely monitor:

- FOMC Meeting: Any signals on the interest rate policy could drive market volatility.

- Economic Data: Key releases like Q4 GDP and PCE inflation will provide insight into economic resilience and inflationary pressures.

- Earnings Continuation: With major reports from Amazon (AMZN), Apple (AAPL), and Exxon Mobil (XOM), next week could set the tone for the broader market trajectory.

Strategic Takeaways

This week highlighted notable trends across sectors and asset classes. Outperforming areas like communication services and healthcare showcased strength, supported by robust earnings and positive developments in specific industries. Meanwhile, the energy sector and certain material industries faced headwinds, reflecting broader market challenges.

Diversification strategies received attention as alternative assets like gold and Bitcoin posted gains amid mixed macroeconomic signals. High-performing stocks such as Netflix and Oracle underscored the importance of earnings momentum in driving market sentiment.

Looking ahead, Investors should stay focused on the long-term picture, avoiding the temptation to let politics drive portfolio decisions. A disciplined, fundamentals-driven approach remains key to navigating this evolving environment. Key macroeconomic releases and upcoming earnings reports from major companies are expected to shape the market’s trajectory, providing further insights into sectoral trends and economic resilience.