Weekly Commentary for the week ending March 08, 2025

Weekly Market Recap.

Key Takeaways:

- U.S. economic growth is showing signs of slowing, with weaker consumer sentiment and softer consumption data.

- Policy uncertainties, including tariffs and government funding concerns, add complexity to the outlook.

- Markets have taken a defensive stance, favoring sectors like healthcare and consumer staples, while momentum and technology stocks lag.

- The Federal Reserve may reenter the picture with potential rate cuts if economic weakness persists.

After a strong end to 2024, the U.S. economy appears to be shifting into a slower gear in early 2025. Fourth-quarter GDP growth stood at 2.5%, supported by robust 4.2% consumer spending. However, recent economic data, including retail sales and personal spending, have fallen short of expectations. The Atlanta Fed’s GDP tracker now signals a contraction of -2.4% annualized growth for the first quarter, a stark reversal from the 3.9% projection earlier this year. This decline is partly due to a surge in imports as companies stockpile ahead of potential tariffs, a trend likely to stabilize.

Consumer spending, which accounts for roughly 70% of U.S. GDP, is now projected to grow at just 0.4% in Q1, down from a prior estimate of 4.1%. A slower consumer sector could weigh on broader economic momentum.

Markets have responded with a shift toward defensive sectors, including healthcare and consumer staples, while momentum-driven stocks like technology have underperformed. Bond markets have also adjusted, with Treasury yields moving lower as investors anticipate potential Federal Reserve intervention.

Corporate earnings expectations have weakened, with first-quarter S&P 500 earnings growth now projected at 7.3%, down from 11.5% at the year’s start. The Fed may counterbalance this slowdown by cutting rates, with markets currently pricing in up to three rate cuts in 2025, depending on inflation and labor market conditions.

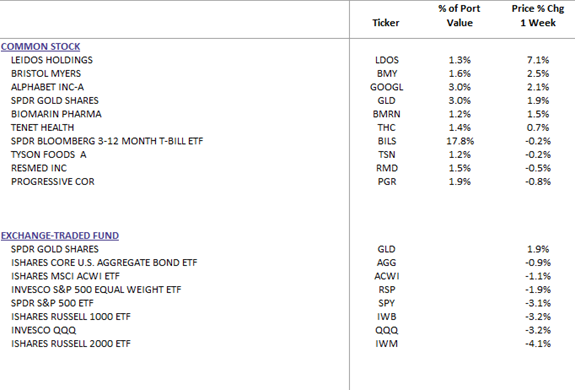

By taking previous defensive positions, such as maintaining gold, reducing technology, increasing healthcare, consumer staples and adding to our cash & short-term treasury positions, our WealthTrust DBS Long Term Growth Strategy, year to date, has significantly outperformed the Russel 1000 Growth Index and is in line with the Russell 1000 Core Index.

We are maintaining this defensive status although we are beginning to identify new entry points in certain oversold companies.

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

Key Market Drivers:

- Macroeconomic Softening and Tariff Volatility:

- Investor sentiment remained risk-averse as fears of an economic slowdown intensified.

- Trade war concerns persisted. Retaliatory measures from China and Canada added to the uncertainty.

A temporary reprieve came as Trump announced a one-month tariff relief for Mexican imports under USMCA, though its limited scope left investors cautious.

- Labor Market and Economic Data:

- February nonfarm payrolls grew by 151K, slightly below the expected range of 150-160K. Meanwhile, January figures were revised lower, and the unemployment rate ticked slightly higher.

- Federal government job losses reached 10K month-over-month, aligning with forecasts, while larger layoffs in federal employment (DOGE-related) are expected between May and September.

- February ISM Manufacturing weakened, with new orders contracting and employment falling, while prices increased amid tariff concerns. However, ISM Services indicated strength in both new orders and employment.

Initial jobless claims fell week-over-week, while February Challenger job cuts surged 103% year-over-year, largely due to federal workforce reductions.

- AI and Technology Sentiment:

- AI-related stocks faced a reality check, with Marvell Technology (MRVL) dropping 22.5% on lukewarm guidance.

- Concerns over a potential AI capex bubble weighed on sentiment, especially after Alibaba (+6.1%) introduced a new AI model to rival DeepSeek.

Broadcom (-2.2%) provided some optimism after exceeding earnings expectations and delivering strong AI-related revenue guidance.

- Geopolitical Tensions and Energy Market:

- The U.S. suspended all aid to Ukraine, intensifying diplomatic tensions. However, reports suggested Russia might be open to a ceasefire under certain conditions, ahead of scheduled U.S.-Ukraine talks in Jeddah.

- Trump signaled potential harsher sanctions on Russia and Iran, particularly targeting the oil sector.

OPEC’s announcement to hike production in April pushed WTI crude to three-year lows despite the geopolitical uncertainty.

Bullish and Bearish Market Developments:

Bullish:

- Retail and corporate investors continued buying the dip, contributing to three consecutive weeks of equity inflows.

- Markets priced in approximately 75 basis points of rate cuts for 2025, with dovish signals from Fed officials Powell and Waller.

- Germany proposed a $500 billion+ infrastructure fund and removal of defense spending caps.

Declining oil prices aligned with White House efforts to curb inflation and lower long-term yields.

Bearish:

- Policy uncertainty fueled volatility, pushing the VIX above 26.0 at one point on Friday.

- Trump dismissed stock market considerations in his trade policy approach, adding to investor anxiety.

- The S&P 500 breached its 200-day moving average, highlighting technical weakness.

Consumer spending resilience was questioned, as retailers continued to issue cautious Q1 guidance.

Looking Ahead: Key macroeconomic events next week include:

- Tuesday: January JOLTS data

- Wednesday: February CPI report (critical for inflation expectations)

- Thursday: Initial jobless claims, February PPI

- Friday: March Michigan Sentiment Index

S&P 500 Sector Performance:

- Outperformers: Healthcare (+0.17%), Materials (-1.18%), Consumer Staples (-1.46%), Industrials (-1.58%), Real Estate (-1.65%), Communication Services (-1.97%), Utilities (-2.44%)

- Underperformers: Financials (-5.92%), Consumer Discretionary (-5.41%), Energy (-3.76%), Technology (-3.39%)

This past week underscored the fragility of market sentiment amid persistent macroeconomic and geopolitical uncertainties. While rate-cut expectations and select AI-driven optimism provided support, concerns over trade wars, economic slowdown signals, and policy volatility drove risk-off behavior. Looking ahead, the February CPI report and ongoing corporate earnings will be crucial in shaping market direction. Investors should maintain a balanced approach while keeping an eye on technical levels and macroeconomic developments.