Weekly Commentary for the week ending March 15, 2025

US Weekly Recap: Dow (3.07%), S&P (2.27%), Nasdaq (2.43%), Russell 2000 (1.51)

Good morning, everyone,

Market Commentary: Correction or Bear Market?

Markets remain volatile, yet diversification has proven its worth in 2025. The S&P 500 dipped into correction territory last week, down 10.1% from its February 19 peak, marking its first 10%+ pullback since October 2023. The Nasdaq, laden with tech stocks, fell 14% at its lows. Economic growth is slowing, consumer confidence is waning, and tariff uncertainty looms, pressuring valuations—particularly in mega-cap tech. Yet, amidst this turbulence, diversification has cushioned the blow. Value and cyclical U.S. sectors, like health care and financials, have outperformed growth stocks, with five of the S&P 500’s 11 sectors posting gains year-to-date. Bonds have outshone equities, as Treasury yields dropped, and investors sought safety. Historically, corrections of 5-15% occur one to three times annually, and while volatility persists, a deep bear market seems unlikely absent a recession. For long-term investors, these dips are opportunities to rebalance. As uncertainty lingers, spreading risk across assets, sectors, and regions remains a prudent strategy.

As highlighted in our past market commentaries, our allocations to a more risk-off status such as reducing technology, adding to healthcare, staples, financials and the 3-12 Month Treasuries ETF (BILS) while maintaining our Gold and Silver allocations has provided significant support during this period of volatility.

WealthTrust DBS Long Term Growth Portfolio Review

As indicated below, the overall Portfolio Stats (highlighted in blue) indicate a better overall valuation compared to the S&P 500 Index and significantly better than the Nasdaq and the Russell 1000 Growth Index.

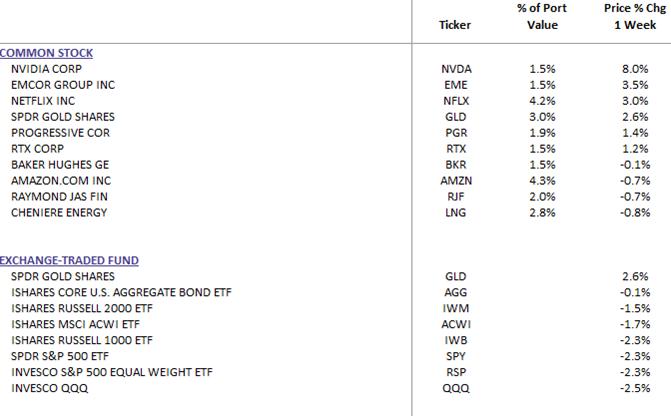

US Equities Decline as Market Enters Correction Territory

The U.S. equity market faced another challenging week, with the S&P 500 dipping into correction territory on Thursday, marking a decline of more than 10% from its February 19 high. Broad-based losses persisted, as reflected in the equal-weighted S&P index, which saw similar declines. While major technology stocks showed relative resilience, with Netflix (+3.0%) and Nvidia (+7.9%) finishing in the green, other sectors experienced substantial weakness. Cosmetics, interactive media, homebuilders, casual dining, department stores (notably Kohl's, -34.0%), IT services, banks, credit cards, machinery, and trucking sectors all faced significant downward pressure.

On the other hand, select sectors outperformed, including industrial metals, utilities, tobacco, property and casualty insurance, exchanges, aerospace and defense, and energy. Despite these pockets of strength, market sentiment remained largely risk-off throughout the week.

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

Market Drivers: Risk-Off Sentiment Prevails

Risk aversion dominated market activity as investors reacted to macroeconomic uncertainties and fluctuating tariff headlines. President Trump reinforced his aggressive trade policies, issuing new tariff threats, including a 200% tariff on European alcohol. In addition, the implementation of 25% tariffs on Canadian aluminum and steel, alongside retaliatory measures from Canada and the European Union, fueled investor apprehension. Market participants continued to fade rallies rather than engaging in dip-buying, signaling a cautious outlook.

Efforts to curb inflation also influenced market dynamics but failed to deter risk-off positioning. February’s Consumer Price Index (CPI) and Producer Price Index (PPI) readings came in cooler than expected, reflecting a deceleration in airline fares, used vehicles, car insurance, and food away from home. However, apparel prices rose while shelter costs remained stable. Despite these developments, Federal Reserve rate-cut expectations remained largely unchanged.

From an economic data perspective, jobless claims ticked slightly lower week-over-week, while January's Job Openings and Labor Turnover Survey (JOLTS) report showed slightly higher-than-expected job openings. However, preliminary consumer sentiment for March fell to its lowest level since November 2022, underscoring broader concerns about economic stability.

Washington and Geopolitical Developments

In Washington, a notable legislative development emerged as the U.S. House & Senate approved a continuing resolution to fund government operations through September 30. The bill, which increases defense spending and grants the White House greater spending flexibility.

On the international front, Russian President Vladimir Putin offered preliminary backing for a proposed 30-day ceasefire in Ukraine. While this move was welcomed, Russia emphasized that many underlying issues still require resolution before a definitive agreement can be reached.

Corporate Highlights

Earnings season continued to drive individual stock movements. Oracle (-3.8%) provided a weaker-than-expected fiscal Q3 and Q4 outlook but highlighted strong remaining performance obligations (RPO) growth due to AI-driven demand. Ultra Beauty (+0.6%) delivered better-than-expected fiscal Q4 results and issued guidance that was considered stronger than feared. However, the airline sector struggled, with Delta (-12.3%) and American Airlines (-16.6%) issuing weaker Q1 forecasts due to reduced consumer and corporate confidence. Conversely, Southwest Airlines (+8.7%) benefited from a cost-cutting plan, new baggage fees, and the acceleration of a $2.5 billion buyback.

Beyond earnings, several corporate developments shaped investor sentiment. Taiwan Semiconductor Manufacturing (-1.7%) reportedly engaged in discussions with Nvidia (+7.9%), AMD (+0.7%), and Broadcom (+0.3%) regarding a potential joint venture to operate Intel (+16.5%) factories, with Intel receiving a boost following the announcement of Lip-Bu Tan as its next CEO. Meanwhile, Walmart (-6.9%) executives were summoned by China’s Ministry of Commerce over negotiations involving price reductions with Chinese suppliers. In the transportation sector, Uber (-6.2%) scrapped its planned acquisition of Delivery Hero’s Food Panda business. Meanwhile, Molson Coors (+3.6%) benefited from speculation that Trump’s proposed EU tariffs could impact alcohol imports.

Market Performance and Sector Trends

The performance of major asset classes was mixed:

- Treasuries: Mostly firmer, reflecting a flight to safety.

- Dollar Index: Down 0.1%, suggesting modest currency pressure.

- Bitcoin Futures: Down 2.7%, extending recent losses.

- Gold: Surged 2.9%, breaking above $3,000/oz for the first time.

- WTI Crude: Declined 0.7%, marking its eighth consecutive weekly decline, the longest streak since 2015. This should help in reining in inflation.

Looking Ahead: Key Events Next Week

Market participants will be closely watching key macroeconomic data and corporate earnings in the coming week:

Macroeconomic Data:

- Monday: February Retail Sales, March Empire State Manufacturing Index

- Tuesday: February Housing Starts, February Industrial Production

- Wednesday: Federal Open Market Committee (FOMC) Meeting

- Thursday: Weekly Jobless Claims, February Existing Home Sales

This coming week should provide more clarity as to the current state of our economy. With uncertainty lingering over trade policies, inflation progress, and economic growth, we will be closely monitoring upcoming data releases and corporate earnings for further clues about the market’s direction and our response to the data.