Weekly Commentary for the week ending March 22, 2025

Weekly Market Commentary for the Week Ending March 21, 2025

Market Summary

- Indices Performance:

Dow Jones: +1.20%

S&P 500: +0.51%

NASDAQ: +0.17%

Russell 2000: +0.63%

Key Takeaways: The Federal Reserve maintained its target range for the federal funds rate at 4.25%–4.5% during its March meeting, reflecting a cautious approach amid slowing economic growth and ongoing policy uncertainty. The Fed anticipates two rate cuts in 2025, indicating a shift toward easing monetary policy as inflation concerns persist.

Despite a pullback in U.S. stocks from February peaks, market diversification proved beneficial, with bonds and international equities supporting portfolios. Key economic indicators revealed that while growth is moderating, the labor market remains resilient, and manufacturing sectors are showing signs of recovery.

The Conference Board’s Leading Economic Index (LEI) fell 0.3% in February, driven by weaker consumer expectations and lower manufacturing orders. However, this decline does not signal an imminent recession, as jobless claims remain low and industrial production surpassed expectations with a 0.7% increase.

Looking ahead, investors should prepare for upcoming economic data releases, including March PMIs, consumer confidence, and durable goods orders. As tariffs loom, the Fed's cautious stance will likely continue until more clarity emerges. Diversification remains key; consider adjusting allocations to bonds and gold, which we've already done to enhance portfolio resilience.

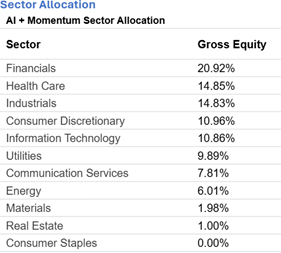

Below is our AI + Momentum Sector Allocation Analysis which reflects which sectors to over/under weight based on momentum and associated sector news.

This analysis provides us with feedback to our current strategies sector allocations.

As indicated below, our strategy is built to weather the current volatility with key metrics significantly better than the relative indexes.

Overview

U.S. equities experienced a positive week, with the S&P 500 and NASDAQ managing to achieve modest gains after four consecutive weeks of declines. Notably, large-cap technology stocks faced mixed results, with Apple (+2.2%) standing out positively, while NVIDIA saw a decline of 3.3%. Sectors such as semiconductors, apparel, and real estate investment trusts (REITs) lagged, while managed care, energy, and financials showed strong performance.

Treasury yields were firmer, contributing to a steepening of the yield curve. The U.S. dollar strengthened against both the euro and sterling, with the DXY index rising 0.4%. Gold continued its upward trend, gaining 0.7% for the week, marking its rise in 11 out of the past 12 weeks. Oil prices also increased slightly, with WTI crude rising 1.6%, but remained below the $70 per barrel mark.

Market Drivers

The S&P 500 steadied amid a backdrop of mixed economic signals. One significant factor was the relative calm in trade policy discussions, as the market reacted positively to the absence of major trade-related announcements from the Trump administration. Nevertheless, the looming deadline of April 2nd for the implementation of potential reciprocal tariffs remains a point of concern for investors.

Additionally, the dovish sentiment from the March Federal Open Market Committee (FOMC) meeting supported bullish market sentiment. The Fed maintained interest rates at current levels, signaling two potential rate cuts in 2025, despite a slightly pessimistic economic outlook characterized by lowered GDP forecasts and rising inflation expectations.

Economic data released this week was generally well-received. While February retail sales fell short of expectations, control-group sales that contribute to GDP exceeded forecasts. February housing starts also came in significantly above predictions, although building permits matched expectations. Initial jobless claims were in line with forecasts, while the Philadelphia Fed's manufacturing index showed strength, contrasting with a notable drop in the NY Fed Empire survey.

Despite these positive indicators, investor sentiment remains cautious regarding the potential impact of waning consumer spending amid ongoing macroeconomic uncertainties and an unpredictable political landscape.

Looking Ahead

The upcoming week will bring several key economic reports and events that could influence market direction:

- Economic Calendar:

March PMIs: Monday

Consumer Confidence, New-Home Sales, Richmond Fed Manufacturing: Tuesday

February Durable-Goods Orders: Wednesday

Jobless Claims, Pending-Home Sales: Thursday

February PCE and Final UMich Consumer Sentiment: Friday

The Treasury will auction $183 billion in 2-, 5-, and 7-year notes, which could also impact interest rates. Additionally, there will be several scheduled appearances by Federal Reserve officials, providing further insights into monetary policy.

Sector Performance

- Outperformers:

Energy: +3.19%

Financials: +1.89%

Healthcare: +1.08%

Industrials: +0.85%

- Underperformers:

Consumer Staples: -0.26%

Materials: -0.25%

Utilities: -0.21%

Communication Services: -0.10%

Technology: -0.07%

Real Estate: -0.06%

Consumer Discretionary: -0.03%

Conclusion

The week ending March 21, 2025, showcased a resilient performance in U.S. equities amidst a complex economic landscape. As always, we will continue to adjust our allocations based on the current economic environment.