Weekly Commentary for the week ending March 29, 2025

Weekly Market Update: Equity Pullback Resumes Amid Tariff Concerns and Cautious Consumer Sentiment Overview

Amid ongoing trade uncertainty, investors are grappling with heightened market volatility as newly announced tariffs disrupt global markets. A 25% tariff on non-U.S. made autos was recently unveiled, with further reciprocal tariffs set to take effect on April 2. While this announcement may provide some clarity, uncertainty is likely to persist as countries retaliate or negotiate.

Despite trade concerns, the broader economic picture remains stable. The U.S. economy, less reliant on trade than many of its partners, may experience a slowdown, but tariffs alone are unlikely to derail growth. Corporate profits continue to rise, job growth remains healthy, and the Federal Reserve is maintaining a cautious stance on interest rates. Additionally, potential pro-growth policies, including tax cuts and deregulation, could provide further support.

For investors, focusing on known fundamentals rather than reacting to headlines is crucial. Market drivers, such as corporate earnings growth—projected at 11% for 2025—and stable credit conditions, suggest that economic expansion remains intact. Although uncertainty weighs on sentiment, history shows that pullbacks can present opportunities for long-term investors.

In terms of portfolio strategy, a balanced approach between growth and value investments is advisable. Sectors like health care and financials, which are less exposed to trade risks, offer attractive valuations. Financials, in particular, may benefit from pro-growth policies. Furthermore, diversification remains key, with fixed-income investments helping to offset potential equity volatility.

While trade uncertainty may persist, staying focused on economic fundamentals can help investors navigate market turbulence and position themselves for long-term success.

U.S. equities reversed course this past week, with the S&P 500 retreating toward correction territory after eking out modest gains the week prior. Selling pressure was broad-based, though the Equal-Weight S&P Index outperformed the headline index by approximately 35 basis points. Big tech names saw notable weakness, with the exception of Tesla (+5.9%) standing out as a rare bright spot. Other lagging segments included semiconductors, software, tech hardware, cruise lines, auto retailers, industrial machinery, airlines, copper/aluminum, and regional banks.

In contrast, defensive and value-oriented sectors found support. Consumer staples led the way, followed by energy, casual dining, dollar stores (highlighted by Dollar Tree’s +8.9% gain), insurance, managed care, and waste management.

On the macro front, Treasuries were firmer as the yield curve steepened. The Dollar Index slipped 0.2%. Commodities showed strength, with gold climbing to new record territory and WTI crude logging a 1.6% gain—its third straight weekly advance. Bitcoin futures were marginally higher by 0.3%.

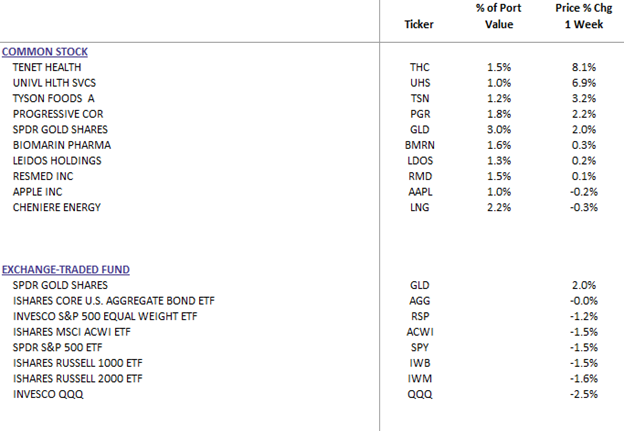

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

What Drove the Market?

Tariffs Take Center Stage

Trade developments dominated headlines, with investor focus squarely on the April 2nd tariff announcement. Reports suggest the White House is exploring a two-step strategy involving rarely used presidential authority to impose tariffs up to 50%, alongside Section 301 investigations targeting trade imbalances. President Trump signed an executive order this week establishing permanent tariffs on autos not made in the U.S., starting at 2.5% and ramping to 25%.

Market participants began to price inflationary implications. Wedbush noted new car prices could rise $5,000–$10,000 on average, while JPMorgan projected a 9–12% near-term jump in used car prices. Retaliatory actions from Canada and Mexico could add further inflationary pressure, a point underscored by St. Louis Fed President Musalim, who cited tariffs as a growing upside risk to inflation.

Consumer Caution Grows

Signs of consumer fatigue continued to emerge. March consumer confidence declined for the fourth consecutive month, while final March sentiment data also dipped. Inflation expectations moved higher. Lululemon noted increasing consumer caution during its earnings call—a sentiment echoed by UBS strategists, who warned that a more hesitant consumer could be a broader equity market risk. This cautious tone was reinforced by the largest weekly outflow from U.S. equities this year at -$20.3B, suggesting dip buyers are becoming less enthusiastic.

Economic Data: Mixed Signals

February core PCE came in slightly above expectations, while headline inflation was in-line. Both personal income and spending outpaced estimates. Durable goods data was mixed—headline orders beat, but core capital goods unexpectedly contracted. Meanwhile, Q4 GDP was revised up to 2.4% SAAR from 2.3%, driven by stronger consumer spending. The labor market held steady with jobless claims printing near expectations. However, the March flash manufacturing PMI from S&P Global fell into contraction territory, while February new home sales met consensus.

Silver Linings

Despite negative sentiment, some positive developments emerged:

- President Trump indicated reciprocal tariffs set for April 2 would be “very lenient.”

- The EU is reportedly preparing concessions to avoid an escalating trade battle.

- Tariffs on China could be reduced to secure a resolution on TikTok.

- Congressional Republicans fast-tracked a reconciliation plan that includes a debt ceiling increase.

- The U.S. services sector remains resilient, with March flash PMI expanding unexpectedly.

- Labor market data continues to show underlying strength.

Looking Ahead: Key Events Next Week

Economic Releases

- Monday: March Dallas Fed Index, Chicago PMI

- Tuesday: March ISM Manufacturing, February JOLTS, Final PMI Manufacturing

- Wednesday: March ADP Employment, February Durable Goods

- Thursday: March ISM Services, Jobless Claims, Final Markit PMI

- Friday: March Nonfarm Payrolls

Notable Earnings

- Tuesday (PM): CALM, SPWH

- Wednesday (AM): BlackBerry (BB)

- Thursday (AM): ConAgra (CAG), Lamb Weston (LW); (PM): Guess? (GES), Levi’s (LEVI)

Sector Performance Breakdown

Outperformers:

- Consumer Staples (+1.65%)

- Energy (+0.77%)

- Real Estate (+0.45%)

- Consumer Discretionary (+0.05%)

- Financials (-0.16%)

- Utilities (-0.21%)

- Materials (-0.34%)

- Healthcare (-0.99%)

- Industrials (-1.26%)

Underperformers:

- Technology (-3.65%)

- Communication Services (-3.23%)

Final Thoughts

The equity market continues to navigate a complex landscape marked by rising inflation risks, heightened trade tensions, and signs of consumer strain. Despite these headwinds, select pockets of strength—both sectoral and macro—offer reason for cautious optimism. Next week’s data-heavy calendar and ongoing developments on the tariff front could set the tone for April. As always, we remain focused on risk management, selective positioning, and long-term value creation.