Weekly Commentary for the week ending November 2, 2024

Weekly Market Update: Key Insights for Investors Amid Mixed Earnings and Economic Signals

The past week was marked by a slightly defensive turn in the markets, with the major U.S. equity indices generally declining. The S&P 500 dropped for the second week in a row following a strong six-week rally, while the Nasdaq, after reaching a new all-time high on Monday, ended the week in the red, snapping a seven-week winning streak. Here’s an overview of the primary market drivers, sectors to watch, and what’s on the horizon for investors.

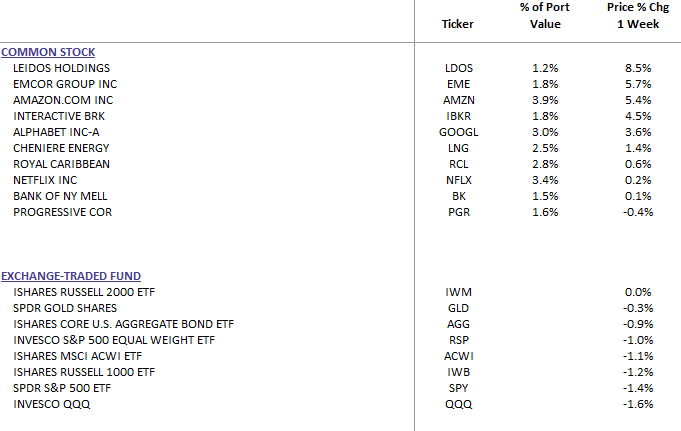

WealthTrust Long Term Growth Portfolio Weekly Top 10

Key Market Trends and Sector Movements

The week highlighted notable divergences in sector performance. Big tech, traditionally a market leader, was a drag on returns, largely due to mixed earnings results from several of the Mag 7 tech giants. The equal-weighted RSP index managed a 1.0% loss, although outperforming the cap-weighted S&P, suggesting that strength in other areas provided some offset to big tech’s weaker showing.

Underperforming sectors this week included autos and suppliers, energy, semiconductors, pharmaceuticals, and real estate. On the other hand, several areas saw strong performance, with airlines, media, biotech, credit cards, and banks, leading gains. This varied sector performance underscores the importance of portfolio diversification, particularly in times when large-cap tech companies face headwinds.

Interest Rates and Currency Movements

The bond market faced pressure again this week, with Treasury yields moving higher, especially in the intermediate range of the curve. Despite some stabilization midweek, a $183 billion issuance was a challenge for the market to absorb. The Q4 Treasury refunding announcement kept issuance levels steady, which was expected but nonetheless left investors cautious about higher yields in the near term.

In the currency market, the U.S. dollar was relatively flat overall, though it lagged against the British pound and outperformed against the yen and euro. Gold, which had seen gains for three consecutive weeks, slipped by 0.3%. Meanwhile, oil prices fell by 3.2%, driven lower despite geopolitical concerns later in the week regarding potential escalation in the Middle East.

Mixed Earnings and Economic Data

With about 70% of S&P 500 companies having reported Q3 results, earnings season has offered some positive surprises. The year-over-year earnings growth rate now stands at 5.1%, a notable improvement from the 4.3% expected at the start of the quarter. However, the rate of earnings beats and the size of those beats are below one- and five-year averages, suggesting that while companies are generally delivering on expectations, there are pockets of weakness and caution in forward guidance.

Notably, big tech companies—often referred to as the Mag 7—delivered a mixed bag. Apple (AAPL) exceeded iPhone expectations but offered tepid guidance for December, raising questions about the pace of its AI-driven product cycles. Microsoft (MSFT) performed well but faced scrutiny over projected slowing Azure growth, despite robust demand commentary. Google (GOOGL) impressed with AI-driven gains in its Cloud segment, while Amazon (AMZN) outperformed on margins but noted modest AWS growth. Meta (META) had a good report but flagged concerns about its investment cycle.

Outside of tech, there were some strong individual performances which reported better-than-expected results. On the flip side, Super Micro Computer (SMCI) faced a significant decline after its auditor, Ernst & Young, resigned due to management concerns.

Economic Signals: Labor Market and Consumer Confidence

The big economic report of the week was October’s nonfarm payrolls, which showed a very low 12,000 job increase. This fell significantly below expectations, with analysts attributing some of the softness to recent hurricanes and strikes. While the labor market appears to be cooling, initial and continuing jobless claims beat expectations, suggesting that layoffs remain low despite the slow growth in new hiring.

There were also mixed signals from other economic indicators. The ISM Manufacturing index missed consensus estimates, with contraction in new orders but an uptick in prices. However, consumer confidence exceeded expectations, reflecting a positive shift in the labor market outlook among respondents. The flash reading for Q3 GDP showed steady growth, driven by strong consumer spending.

Market Sentiment and Upcoming Catalysts

Overall, market sentiment has retained a bullish bias. This optimism is underpinned by strong earnings, robust consumer spending, and ongoing confidence in AI-driven growth. Expectations of further easing by the Federal Reserve have also buoyed markets. At the same time, there are several factors that investors should watch closely. Geopolitical risks, higher Treasury yields, and the upcoming U.S. elections all contribute to a climate where caution may be warranted.

Next week brings additional potential catalysts. Election Day in the U.S. will take place on Tuesday, November 5, with the close race expected to keep investors on edge. The Federal Open Market Committee (FOMC) meeting, rescheduled to Thursday due to the election, could provide further clarity on the Fed’s path for rate cuts. The Q3 earnings season will continue, with reports from 103 S&P constituents, including many large-cap names.

Sector Performance Recap

- Outperformers: Communication Services (+1.53%), Consumer Discretionary (+0.48%), Financials (+0.18%), Healthcare (+0.57%), Industrials (+1.03%), Materials (+1.22%), Consumer Staples (+1.31%)

- Underperformers: Technology (-3.28%), Real Estate (-3.07%), Utilities (-2.81%), Energy (-2.13%)

Final Thoughts for Investors

In a market environment defined by both bullish and bearish crosscurrents, diversification remains a critical strategy. The ongoing earnings season has provided some upside surprises, but the broader economic and geopolitical landscape suggests that volatility may persist. Investors should keep an eye on next week’s election and FOMC meeting for clues on potential policy shifts, while also focusing on sectors with resilient earnings and growth prospects.

Staying informed and prepared for shifts in sentiment will be key to navigating the weeks ahead.