Weekly Commentary for the week ending October 11, 2024

This week marked another strong performance for U.S. equities, with the S&P 500 and Nasdaq recording their fifth consecutive week of gains. The S&P 500 closed at a new all-time high, crossing the 5800 mark, while the Nasdaq remains just 1.6% below its record close from July. The small-cap Russell also performed well, particularly boosted by a strong Friday.

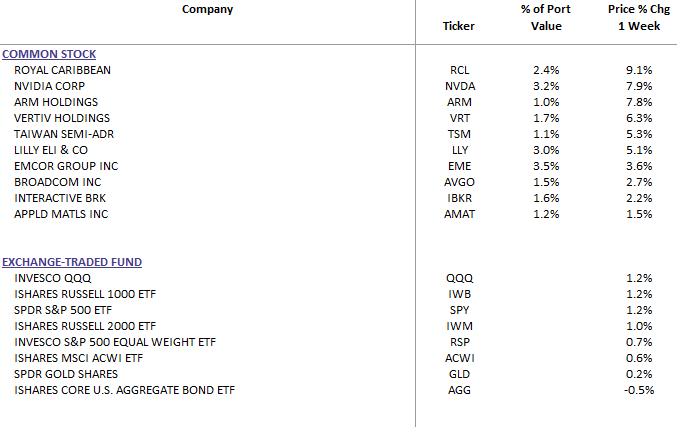

WealthTrust Long Term Growth Portfolio Weekly Top 10

Key Performers: Banks were standouts, especially following earnings reports from major players like JPMorgan Chase (+5.2%) and Wells Fargo (+7.1%). Semiconductor stocks, transportation, multi-sector companies, asset managers, and managed care also outperformed. NVIDIA (+7.9%) was a highlight among the Mag 7 tech stocks, while Tesla (-12.9%) dropped significantly after disappointing the market with its Robotaxi product event. On the downside, utilities, oil services, chemicals, REITs, and food stocks struggled, though property and casualty insurers saw some recovery later in the week.

Economic Insights: The Federal Reserve remained in focus this week, though no major shifts in monetary policy expectations emerged. Markets still anticipate another 25-basis point rate cut in November, but Fed officials maintained a cautious, data-driven approach. Notably, Atlanta Fed President Bostic suggested he could support skipping the rate cut if the data warranted it.

Economic data this week was mixed. Headline and core CPI readings came in slightly ahead of expectations, with notable increases in airline fares, used cars, and vehicle insurance. However, shelter inflation, which has been persistently high, showed signs of easing. On the flip side, a jump in weekly jobless claims raised concerns, though ongoing strikes and Hurricane Helene’s impact contributed to the rise.

The start of Q3 earnings season also garnered significant attention. So far, only 24 S&P 500 companies have reported, but early indications are promising, with analysts now expecting over 7% earnings growth for the quarter, up from the 4.4% forecast just a couple of weeks ago. This improvement, coupled with a relatively positive outlook for Q4, has bolstered the market’s mood.

Corporate Highlights: JPMorgan led the charge with a 5.2% jump in its stock after reporting better-than-expected net interest income and trading revenues, while raising its guidance. Wells Fargo’s earnings also surprised on the upside, despite missing on net interest income. Fastenal (+9.5%) was another standout, highlighting strong new account wins.

In tech, Amazon saw a modest 1.2% rise after announcing that its "Prime Big Deal Days" event was its most successful October shopping event ever. On the other hand, Alphabet (-2.3%) faced regulatory headwinds as the Justice Department hinted at a possible breakup to tackle its dominance in search. Tesla, after a much-anticipated Robotaxi event, faced investor disappointment, with its stock tumbling 12.9%.

Looking Ahead: Next week will bring a slew of economic releases, including the NY Fed's Empire manufacturing survey, retail sales, jobless claims, and the Philly Fed index. The housing sector will also be in focus with the release of housing starts and permits data. Moreover, we will see earnings reports from major S&P 500 constituents, including Bank of America, Citigroup, Goldman Sachs, and Netflix.

Sector Performance:

- Outperformers: Technology (+2.50%), Industrials (+2.10%), Financials (+1.81%), Healthcare (+1.46%)

- Underperformers: Utilities (-2.57%), Communication Services (-1.39%), Consumer Discretionary (-0.85%), Energy (-0.54%), Real Estate (-0.27%)

Final Thoughts: Despite a strong start to Q3 earnings and positive seasonality trends for Q4, caution remains due to extended valuations and lingering geopolitical uncertainties. Additionally, the Federal Reserve’s stance and upcoming U.S. presidential election add layers of uncertainty. Investors are advised to remain vigilant and consider rebalancing portfolios to reflect these evolving dynamics.

This week’s performance underscores the importance of maintaining a diversified approach, as sector rotation continues to present both opportunities and risks in the current environment.