Weekly Commentary for the week ending October 18, 2024

Major Indices Extend Winning Streak Amid Mixed Sector Performance

The U.S. equity markets continued their bullish momentum last week, marking the sixth consecutive week of gains for the Dow Jones Industrial Average, S&P 500, and Nasdaq. The S&P 500 closed at another record high, driven by notable gains in big tech, with Apple (+3.3%) and Nvidia (+2.4%) leading the charge. Other strong performers included airlines, asset managers, banks, homebuilders, and retail, while sectors like managed care, energy, and machinery lagged behind.

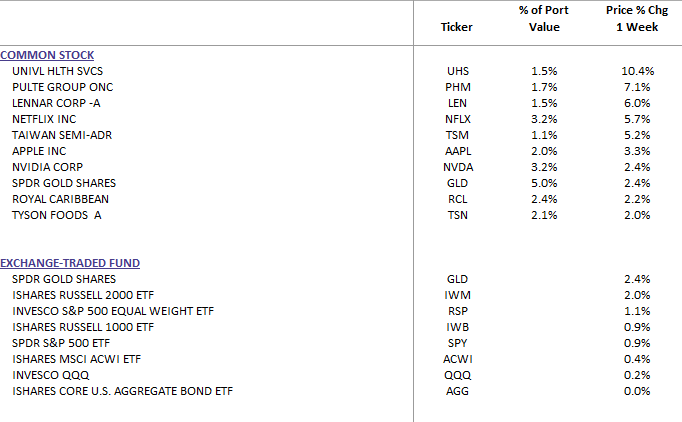

WealthTrust Long Term Growth Portfolio Weekly Top 10

Key Market Developments:

- Economic Indicators:

- The "soft/no-landing" economic narrative gained more traction, buoyed by robust data releases. September retail sales saw healthy month-over-month growth, while initial jobless claims came in below consensus, signaling a resilient labor market.

- Positive surprises were also evident in the October Philly Fed manufacturing index. Meanwhile, the Atlanta Fed’s GDPNow forecast for Q3 crept up to a 3.4% seasonally adjusted annual rate.

- However, some weaker spots emerged, such as a negative October NY Fed Empire manufacturing index and mixed housing data.

- Earnings Season:

- With about 14% of the S&P 500 having reported, Q3 earnings results were generally positive, reflecting year-over-year EPS growth of 3.4%, though slightly below earlier estimates of 4.3%. Notable strength came from banks, which reported stable credit conditions and a resilient consumer base.

- AI remained a focal point, with positive results from TSMC (+5.2%) and encouraging comments despite ASML’s (-14.0%) weaker guidance outside AI-related demand.

- Market Sentiment:

- The sentiment was further supported by increased expectations of China’s economic stimulus, favorable thoughts about potential political outcomes in the upcoming U.S. elections, easing geopolitical tensions, and positive seasonality.

- However, concerns about demand trends outside of AI, softness in luxury consumer spending, and high valuations weighed on growth stocks, underscoring a complex market backdrop.

Treasuries, Dollar, and Commodities

The Treasury market was relatively stable, while the U.S. dollar strengthened against major currencies, with the DXY index up +0.6%. Gold saw a 2.0% rise, ending the week above $2,700/oz—a new record high. WTI crude oil experienced its sharpest weekly decline since March 2023, down 9.1%, as geopolitical risks appeared to ease.

Sector Highlights

- Outperformers: Utilities (+3.42%), Real Estate (+3.00%), Financials (+2.43%), and Materials (+1.92%) led the market’s advance, benefiting from rotation toward defensive sectors and rate-sensitive stocks.

- Underperformers: Energy (-2.64%), Healthcare (-0.57%), and Communication Services (+0.35%) struggled, as energy stocks were hit by falling oil prices, while healthcare faced mixed earnings results.

Corporate Earnings in Focus

Several high-profile earnings reports shaped investor sentiment:

- ASML (-14.0%): Missed bookings and weaker guidance outside AI segments dragged down semiconductor sentiment, though TSMC’s results offered a more optimistic outlook.

- Netflix (+5.7%): Reported strong net additions, beating expectations.

- Morgan Stanley (+9.6%): Strong results in investment banking and wealth management drove the stock higher.

- Schwab (+5.4%): Signs of stabilization in cash-sweep balances boosted investor confidence.

- CVS (-9.4%): Announced a CEO change and issued weaker-than-expected guidance for Q3.

The Week Ahead: Earnings and Economic Data

Investors are set for a busy week of Q3 earnings reports, with 112 S&P 500 companies on the calendar. Key names to watch include Coca-Cola, T-Mobile, IBM, Lockheed Martin, and UPS. On the economic front, data releases will be lighter, with focus on existing home sales, flash PMIs, and the latest Beige Book report from the Fed.

What This Means for Investors

The broader market remains optimistic, driven by solid earnings results, resilient consumer spending, and a softening rate outlook. Defensive and rate-sensitive sectors are seeing increased interest, while high valuations in growth and momentum stocks could make them vulnerable to shifts in economic data or Fed commentary.

While the backdrop remains favorable, investors should maintain a balanced approach, considering both sector rotations and the potential risks of slower consumer spending in certain areas.

Bottom Line

Markets continue to rally on a mix of strong earnings, resilient economic data, and easing geopolitical fears. However, high valuations and potential Fed caution may pose challenges ahead. A strategic, diversified approach will be key to navigating the evolving market landscape.