Weekly Commentary for the week ending October 26, 2024

US Equities Recap: Tech Outperforms as Broader Markets Lose Momentum

As the equity market wraps up another week, investors witnessed a mixed performance across sectors. The S&P 500 dipped, ending a streak of six consecutive weekly gains, while the Nasdaq Composite achieved a slight increase, marking its seventh straight positive week. The latter now sits just under 1% from its July peak, driven by strength in big tech, especially Tesla (+22%), software, and electric vehicles. Despite these gains, the broader market faced pressure with underperformance across homebuilders, retail, credit cards, and airlines, among others.

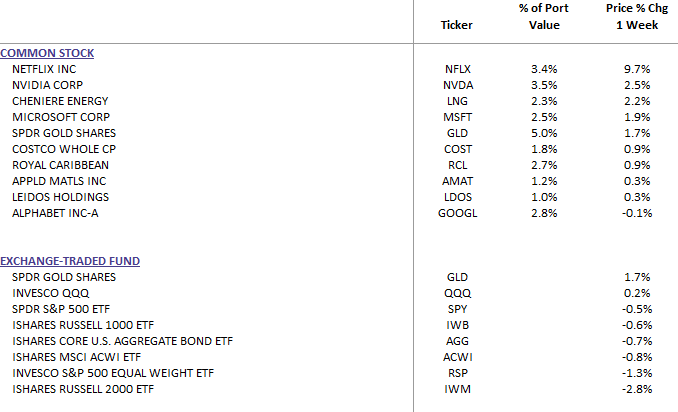

WealthTrust Long Term Growth Portfolio Weekly Top 10

Key Market Drivers

- Rising Treasury Yields: Treasury yields rose again this week, with the 2-year yield climbing back above 4% and the 10-year reaching July levels. This jump was fueled by a mix of potential political shifts, scrutiny over deficits, and a continued “soft landing” narrative. Despite some caution from earnings and economic data, optimism around a resilient economy remains a driver.

- Federal Reserve Sentiment: The Fed remains on course for rate cuts, though the pace of reductions is becoming a topic of debate. The market still expects a 25 basis point cut at the November FOMC meeting and further easing through 2025. While expectations have turned slightly more hawkish, given declining inflation, a Fed still aiming to cut rates may provide support to equities.

- Corporate Updates: Tesla stood out with robust results and guidance, projecting up to 30% vehicle sales growth next year. Other major companies like Texas Instruments also reported positive earnings driven by China’s electric vehicle demand, while IBM faced setbacks in consulting and infrastructure. There’s an increasing divergence in corporate outcomes, underscoring the importance of selectivity in stock picking.

- Economic Data Resilience: The latest manufacturing and services PMIs beat expectations, initial jobless claims were the lowest in a month, and existing home sales reached a 16-month high. These indicators support the narrative of a resilient US economy, despite slowing revenue growth among some corporates.

- China’s Economic Concerns: Skepticism around China’s stimulus measures is growing, with analysts doubting its ability to significantly boost the country’s economic growth. This sentiment weighed on related sectors like materials and industrials, which are often sensitive to China’s growth outlook.

Sector Highlights

- Top Performers: Consumer Discretionary, Tech, Communication Services, and Energy led gains. Strong earnings from Tesla, software names, and select auto retailers supported the Consumer Discretionary and Tech sectors. The Energy sector benefited from a 4.5% gain in WTI crude prices, while positive earnings from media and telecom supported Communication Services.

- Underperformers: Materials, Healthcare, Industrials, Financials, and Utilities lagged, reflecting broader concerns around earnings disappointments, debt pressure, and rate sensitivities.

A Look Ahead: Key Risks & Opportunities

- October Payrolls: The headline payroll growth for October is expected to slow to 125K, marking the third-lowest of the year. The ongoing Boeing strike could negatively impact payrolls by 30K, but the unemployment rate is expected to hold steady at 4.1%.

- Upcoming Earnings Reports: Next week will feature earnings from major names like McDonald’s, Alphabet, Microsoft, Meta, and Amazon. These reports could provide insights into consumer demand, ad spending, cloud growth, and digital transformation—key themes that could shape the broader market's trajectory.

- Treasury Auctions & Refunding: A slew of Treasury auctions and refunding updates could add volatility to yields, with implications for rate-sensitive sectors like Financials and Real Estate.

Investor Outlook: Navigating Near-Term Uncertainty

Despite recent volatility, the broader bullish narrative still hinges on the “soft landing” scenario, further rate cuts, and sustained economic resilience. Investors should focus on quality names within outperforming sectors like Technology and Consumer Discretionary, while keeping an eye on energy stocks that could benefit from ongoing geopolitical risks and supply concerns.

Sector rotation and earnings-driven stock selection will be crucial as we head into the final stretch of 2024. With plenty of cash still on the sidelines and potential catalysts like election outcomes and Fed policy shifts, there remains upside potential for equities. However, risks from higher yields, geopolitical uncertainties, and earnings pressure require a balanced approach, emphasizing diversification and active management.