Weekly Commentary for the week ending September 27, 2024

A Week of Stimulus and Tech Momentum

This past week, U.S. equities exhibited resilience, with the S&P 500 climbing to a new all-time high on Thursday. The Equal Weighted S&P Index outpaced the official S&P 500 by 22 basis points (bps), underscoring the broader market strength. Meanwhile, the Russell 2000 lagged behind other indices but ended Friday with a solid daily gain. On the global front, China’s Heng Seng Index made headlines with its best weekly performance in 26 years, soaring 13% on stimulus news from China’s Politburo.

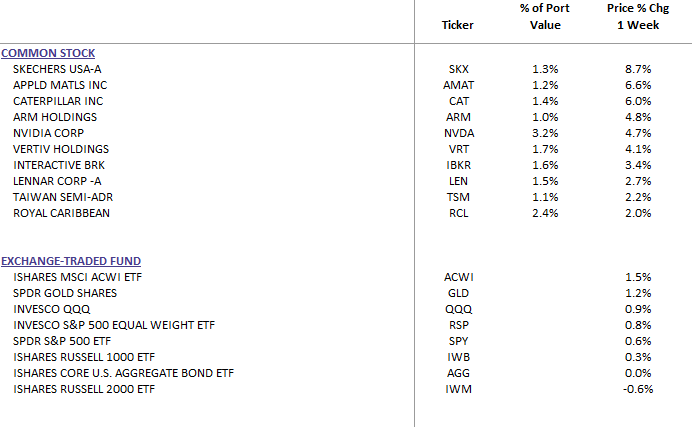

WealthTrust Long Term Growth Portfolio Weekly Top 10

Sector Performance: Tech and Consumer Discretionary Lead

The technology sector had a strong week, with Tesla (TSLA) surging 9.3% and Nvidia (NVDA) gaining 4.6%. These gains were more than enough to offset declines in Amazon (AMZN) and Microsoft (MSFT), which dipped 1.9% and 1.7%, respectively. Other sectors that outperformed included industrial metals, chemicals, machinery, and China tech, highlighted by Alibaba (BABA), which skyrocketed by 21.6%. Notable gains were also seen in semiconductors, hotels, apparel (Estee Lauder +17.5%), and auto retailers. On the flip side, energy, hospitals, biotech, banks, off-priced retail, and waste sectors underperformed.

Macro Highlights: China Stimulus and Economic Data

The week's narrative was heavily influenced by China’s aggressive stimulus measures, which provided a significant tailwind for under-owned Chinese equities. However, the Politburo's failure to address plans for fundamentally boosting domestic demand leaves questions about the sustainability of this rally.

On the domestic front, August’s core Personal Consumption Expenditures (PCE) price index—the Federal Reserve’s preferred inflation gauge—rose just 0.1%, below the consensus of 0.2%. This brought year-over-year core PCE inflation to 2.7%, slightly up from July’s 2.6%. Despite this, personal income and consumption growth decelerated from the prior month. Durable goods orders for August exceeded expectations, while jobless claims slightly missed. The final Q2 GDP was in line with consensus at 3.0%, and housing market data was mixed.

AI and Earnings: A Tale of Two Stories

Artificial intelligence (AI) continued to be a significant growth driver. Micron Technology (MU) surged 18.2% after its fiscal Q4 earnings beat expectations, with particularly strong guidance for the upcoming quarter, driven by favorable pricing, tight supply, and product mix.

Corporate earnings presented a mixed bag. Costco (COST) saw a 2.4% decline despite positive Q4 earnings, as concerns over margins and membership trends persisted. On the other hand, AutoZone (AZO) and Thor Industries (THO) both saw solid gains, with the latter beating expectations across all divisions, though its FY25 guidance fell short of consensus estimates. Notably, Intel (INTC) gained 9.3% on reports of potential acquisition interest from Qualcomm (QCOM) and a multibillion-dollar investment offer from Apollo Global Management (APO).

Global Developments: Monetary Easing and Geopolitical Tensions

Globally, the easing cycle was a focal point, with the Swiss National Bank (SNB) delivering its third consecutive rate cut and signaling the potential for further easing. The European Central Bank (ECB) is also expected to cut rates in October, with JPMorgan predicting cuts at every meeting from October onward. Japan's political landscape saw a surprise as Shigeru Ishiba was picked as the next leader of the ruling party, which could signal a continuation of accommodative monetary policy.

Geopolitically, tensions in the Middle East flared as Israel launched strikes against Hezbollah, with Israel potentially preparing for a ground assault that could escalate the conflict.

Looking Ahead: Key Data and Earnings on the Horizon

Next week’s focus will be on notable earnings from companies like McCormick (MKC), Paychex (PAYX), and Nike (NKE). Key economic releases include the September ISM Manufacturing Index, August JOLTS data, and the September Nonfarm Payrolls report.

Sector Watch: Materials and Consumer Discretionary Shine

In terms of sector performance, Materials led with a 3.38% gain, followed by Consumer Discretionary (+1.75%) and Industrials (+1.56%). The Technology sector also performed well, up 1.13%. On the downside, Healthcare, Energy, Financials, and Real Estate lagged, with Healthcare down 1.12% and Energy declining by 0.82%.

Conclusion: Balancing Optimism with Caution

The combination of AI-driven growth, China's stimulus, and generally positive economic data helped propel equities higher this week. However, investors should remain cautious, as consumer confidence is weakening, manufacturing data is softening, and geopolitical risks are rising. As always, maintaining a balanced and diversified portfolio is crucial in navigating these complex market dynamics. Also, for these reasons, we continue to maintain a portion of all our individual equity strategies in Gold, Silver and Defense Companies.