Monthly Commentary for February 2025

Market Commentary:

The S&P 500 briefly erased its year-to-date gains last week, largely driven by a decline in mega-cap tech stocks. While the index remains 15% higher than a year ago, recent market volatility has been fueled by growth concerns, trade uncertainty, and weakening consumer confidence. Despite these headwinds, economic fundamentals continue to support the broader market, with strong labor trends, corporate earnings growth, and Federal Reserve rate cuts providing a cushion against further downside.

Key Drivers of the Pullback

Growth Concerns

Recent economic data has raised concerns about a soft patch in the first half of the year. January retail sales declined more than expected and the S&P PMI for services fell into contraction for the first time in two years, and initial jobless claims increased. Additionally, the 10-year and 3-month Treasury yield spread has turned negative, a classic recession warning signal. While some of this slowdown may be weather-related, investors remain wary.

Policy Uncertainty

Trade tensions have resurfaced, with new tariffs on Canada, Mexico, and China set to take effect in early March, alongside proposed tariffs on the EU in April. The uncertainty surrounding these policies is impacting business sentiment and could delay investment decisions. Unlike previous tariff cycles, these policy moves are emerging without the offsetting effect of tax cuts, adding to investor unease.

Big Tech Weakness

The once-dominant Magnificent 7 stocks have lagged since 2024, shifting from market leaders to underperformers. NVIDIA’s latest earnings, while strong, failed to exceed sky-high expectations, triggering an 8.5% decline in its stock. The market’s reaction underscores the difficulty of maintaining past growth trajectories. We had previously reduced our allocation to technology but are now looking at technology including the Magnificent 7, except Tesla, as getting closer to being oversold.

Outlook and Investment Strategy

While a market correction remains a possibility, it is not inevitable. The broader index has moved sideways over the past three months, suggesting that much of the excess has already been priced out. Market leadership is broadening beyond large-cap tech, reinforcing the importance of diversification.

Yet, there were glimmers of optimism: a House GOP budget resolution eased gridlock fears, January core PCE met expectations, and the Fed signaled a potential pause in quantitative tightening mid-year. Corporate positives included Nvidia’s demand strength, Microsoft’s $80 billion capex reaffirmation, and unexpected positive comps from Home Depot and Lowe’s.

Looking ahead, continued economic growth, AI-driven investments, and a supportive Fed policy stance should help sustain the bull market. Investors should brace for elevated volatility but remain focused on long-term strategies that emphasize balance and diversification.

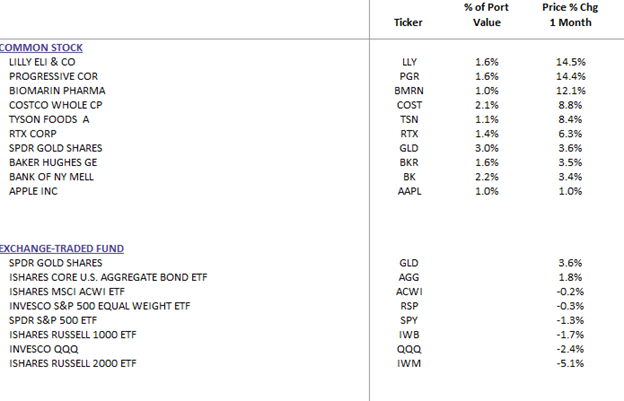

WealthTrust Long Term Growth Portfolio Monthly Top 10 | ETF: WLTG

Sector Highlights

Sector performance underscored the defensive shift:

- Outperformers: Consumer Staples (+5.6%), Real Estate (+4.1%), Energy (+3.2%), Healthcare (+1.4%), Financials (+1.3%), Utilities (+1.2%).

- Underperformers: Consumer Discretionary (-9.4%), Communication Services (-6.3%), Industrials (-1.6%), with Materials (-0.2%) and IT (-1.4%) also lagging.

Earnings Snapshot

With 97% of S&P 500 companies reporting Q4 results, 75% beat EPS estimates, and 63% topped revenue forecasts. Standouts included Nvidia’s strong beat, Alibaba’s 34% surge on AI momentum, and Uber’s gains from Mobility and Delivery. However, disappointments from Amazon, Salesforce, and Walmart tempered optimism, reflecting uneven growth and guidance challenges.

Looking Ahead

February’s volatility reflects a market grappling with mixed signals—hotter inflation, softer growth, and policy uncertainty—offset by pockets of resilience. The interplay of tariffs, inflation, and Fed policy will likely dictate near-term direction, while selective opportunities in defensive sectors and AI-driven growth areas remain worth watching. Balancing risk and reward will be key in this uncertain landscape.

Outlook and Investment Strategy

Given the heightened uncertainty in the market, we have increased our cash & short-term treasury positions in our equity strategies as a precautionary measure. This move allows us to maintain flexibility and mitigate potential downside risks while awaiting clearer economic signals. Elevated volatility, policy unpredictability, and shifting market leadership suggest a more cautious approach is warranted. By having additional liquidity, we can strategically deploy capital when attractive opportunities arise, ensuring a more measured and disciplined investment approach.