Market Recap: 2024 – A Year of Resilience and Surprises

The U.S. economy defied expectations in 2024, growing at an impressive rate of approximately 2.9% despite headwinds like high interest rates and rising unemployment. This resilience was fueled by robust consumer spending and a dominant services sector, which together propelled the economy forward even as traditional economic indicators signaled contraction. For investors, 2024 was a year of remarkable surprises, delivering one of its strongest annual performances in the last quarter-century. These unexpected developments challenge long-held assumptions about economic and market behavior and raise important questions as we look toward 2025.

One of the most striking features of 2024 was how little the Federal Reserve’s aggressive monetary tightening seemed to hinder economic growth. Despite one of the steepest rate-hiking cycles in over four decades, GDP expanded at a rate slightly higher than in 2023. While sectors such as commercial real estate, regional banks, and smaller companies faced significant pressures, alternative financing sources from the shadow banking system, including private equity, appeared to buffer the broader economy. Additionally, the increasing concentration of wealth among large corporations and affluent households, which are less sensitive to interest rate changes, likely supported continued spending.

Unemployment, which rose from 3.7% to 4.2% over the year, similarly failed to dampen consumer spending. Traditionally, such an increase in joblessness would signal a slowdown in economic activity. However, several factors, including concentrated wealth and the economic contributions of immigration, helped sustain demand. Immigration alone is estimated to have added 1% to real GDP in 2024, underscoring its significance in maintaining economic momentum.

The economy’s shift from manufacturing to services further complicated the narrative, rendering many traditional indicators less reliable. Metrics such as The Conference Board’s Leading Economic Index and the Institute for Supply Management’s manufacturing index consistently predicted contraction, yet the economy continued to expand. This misalignment reflects the increasing dominance of the services sector and the growing influence of a few multi-industry giants, which have reshaped the economic landscape.

Even as the Federal Reserve tightened monetary policy through rate hikes and quantitative tightening, financial conditions remained unexpectedly loose. A major contributor was the U.S. Treasury’s strategic focus on issuing short-term Treasury bills, which were quickly absorbed by money market funds eager for yields exceeding 4%. This approach kept cash flowing through the financial system, enabling continued access to credit for consumers and businesses alike.

The stock market, particularly the technology sector, was another standout story in 2024. Enthusiasm around generative AI and other innovations drove valuations of mega-cap tech companies to new heights. Despite higher interest rates, which typically pressure richly valued equities, these companies thrived, propelling the S&P 500 to levels far exceeding most analysts’ forecasts. This surge highlights the concentrated nature of market gains, with a handful of companies driving much of the year’s performance.

The U.S. economy and markets surprised many in 2024, defying predictions and challenging traditional models. As the new year begins, investors must remain vigilant, prepared to adapt to a world where the unexpected has become the norm.

The year 2024 proved to be a robust period for the US equity markets, with major indices posting impressive gains. The S&P 500 closed the year up more than 20%, marking its second consecutive year of 20%+ growth, a feat not seen since 1998. Despite this, the performance was significantly driven by the so-called "Magnificent Seven" tech giants. Excluding these names, the equal-weighted S&P saw a more modest increase of 11.1%, highlighting the concentrated nature of the gains.

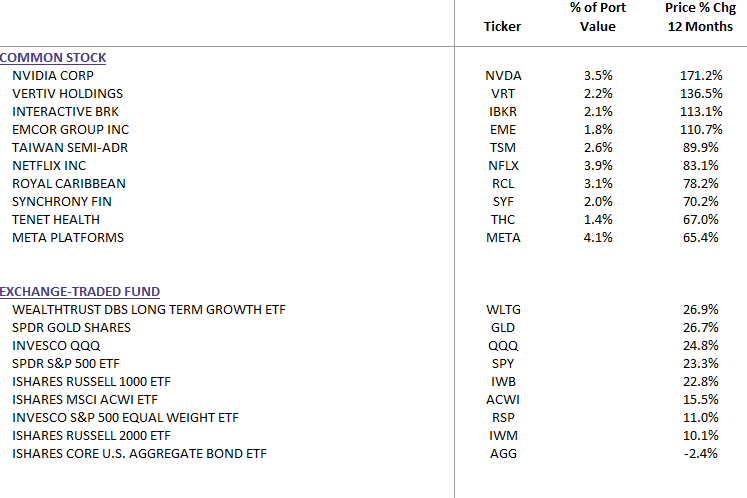

WealthTrust Long Term Growth Portfolio Year End Top 10 | ETF:WLTG

Sector Performance: Winners and Losers

Technology stocks led the charge, with Nvidia (NVDA) surging 171.2%, while Tesla (TSLA) saw a 62.5% jump, primarily after the November presidential election. Other standout sectors included semiconductors, cybersecurity, networking, airlines, and financial services, with large-cap banks and asset managers also showing strength. In contrast, sectors such as energy, industrial metals, chemicals, and managed care lagged behind, underperforming relative to the broader market.

The 2024 performance across various indices showed broad market strength but with some key distinctions. The Russell 2000, which tracks small-cap stocks, rose 10.02%, a solid gain but significantly lower than the S&P 500’s performance. The Nasdaq, with its heavy tech weighting, outperformed the broader market.

Interest Rates, Bonds, and the Dollar

Treasuries experienced a weakening trend throughout the year, with the yield curve steepening. Despite the start of Fed rate cuts and a 100bps reduction in the year, the 10-year yield rose by 69bps, reaching 4.57% by year-end. This rise reflected investor concerns over inflation and deficit spending. The US dollar also gained strength, up 7% against a basket of currencies (DXY), driven by resilient US economic growth and expectations that the Fed would remain cautious in its rate cuts.

Commodities saw divergent performances. Gold rose 27.5%, hitting an all-time high above $2,800/oz, while oil prices remained relatively stable, with WTI crude ending the year virtually unchanged. Bitcoin futures surged an impressive 122%, driven by optimism surrounding the incoming Trump administration and the continued mainstream acceptance of cryptocurrencies.

Economic Growth: Navigating Challenges

The US economy showed signs of resilience in 2024, despite some uneven progress. GDP growth fluctuated, with Q1 coming in at a modest 1.6% annualized rate, but accelerating to 3.0% in Q2 and 3.1% in Q3. Nonfarm employment grew by nearly 2 million jobs through November, although the unemployment rate edged up to 4.2%, from 3.7% at the end of 2023. Retail sales remained strong, buoyed by solid holiday spending, while inflation showed signs of easing, with the Consumer Price Index (CPI) rising 2.7% year-over-year in November.

The Fed’s monetary policy played a pivotal role throughout the year. Initially, expectations of rate cuts were tempered by inflation data that came in hotter than expected. However, by mid-year, the Fed signaled its readiness to ease. The Fed ultimately cut rates by 50bps in September, followed by additional cuts in November and December, though concerns about the pace and scope of these reductions persisted.

A Changing Political Landscape

The US presidential election, which had the potential to shift the economic and market landscape, ultimately saw Donald Trump secure a victory, defying early predictions. The market responded positively to the election outcome, with both the S&P and Russell 2000 posting strong performances in November. There was optimism about potential corporate tax cuts, deregulation, and policies favorable to energy production and mergers and acquisitions. However, the threat of trade tensions and concerns about a widening federal deficit left some uncertainty in the market.

Corporate Earnings: Driven by Tech

US corporate earnings in 2024 continued to grow, with the S&P 500 posting a 9.5% year-over-year increase in earnings, exceeding the ten-year average of 8%. However, this growth was highly concentrated in the "Magnificent Seven" tech stocks. The remaining companies in the index saw more modest earnings growth of just over 4%. Despite this, the overall earnings growth was a testament to the continued strength of the corporate sector, particularly in technology and financial services.

Looking Ahead to 2025: Optimism with Caution

Market analysts are generally optimistic about the continued strength of the market, projecting a year-end S&P level in the range of 6500-6600. The forecast is supported by expectations of solid earnings growth, further Fed rate cuts, and the broader adoption of technologies like AI and quantum computing. However, there are concerns about the pace of rate cuts, potential policy-driven inflation threats, and the resilience of the labor market amid ongoing political uncertainties. While 2024 was a year of strong performance in the equity markets, it was also marked by concentrated growth, with a few key sectors driving the majority of gains. As we move into 2025, investors should maintain a cautious yet optimistic outlook, keeping an eye on economic data, Fed policy, and political developments that could shape the investment landscape.

As we look ahead to 2025, the remarkable resilience and unpredictability of 2024 serves as a reminder of the importance of active risk management in investment portfolios. Rebalancing to align with strategic allocation targets and diversifying across asset classes remain critical steps for navigating an increasingly complex financial environment. The lessons of 2024 reinforce the need to stay agile and informed, as the interplay between economic policy, market dynamics, and global trends continues to shape the investment landscape.