Market Overview

Market Overview: An Investment Manager's Insights

In the past week, U.S. equities demonstrated a positive trend despite a shortened trading week, with the Equal Weight S&P outperforming the official index. Notably, the Nasdaq lagged other major indices. Big tech stocks generally saw gains, though NVIDIA (NVDA) underperformed. Key outperforming sectors included energy equipment, department stores, casual dining, casinos (PENN +13.9%), aerospace & defense, trucking, credit cards, property & casualty insurers, and household products. Conversely, underperformers encompassed REITs, medical devices, managed care, biotech, homebuilders, auto retailers, Chinese tech, agriculture, and global mining companies.

In the bond market, treasuries exhibited mixed performance with yields rising across the curve. The dollar strengthened against major currencies, while gold fell by 0.7%. Crude oil prices surged by 3.4%, driven by optimistic summer demand projections.

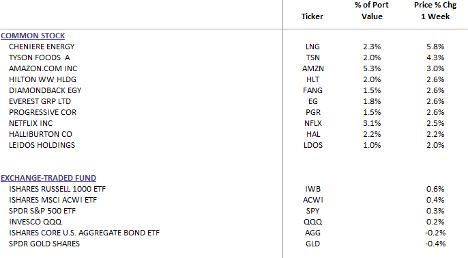

WealthTrust Long Term Growth Portfolio Weekly Top 10

Weekly Market Dynamics

Equities began the week robustly before losing momentum towards the end. Expectations for Fed rate cuts were bolstered by a weaker retail sales report, adding to evidence of a cooling U.S. economy. This report followed softer-than-expected CPI and PPI data earlier in the month. Enthusiasm for artificial intelligence (AI) also buoyed sentiment, although NVDA's 4.0% decline marked it as a laggard even as it surpassed Microsoft (MSFT) to become the most valuable public company. However, later in the week, AI stocks faced selling pressure due to growth sustainability concerns.

Macroeconomic Highlight

The retail sales report was a focal point, with headline numbers missing expectations partly due to lower gas prices. Excluding gasoline, retail sales increased by 0.3%, with declines in five of the thirteen tracked categories. Economists noted the report indicated cautious consumer behavior and a gradual cooling of spending. This added to the narrative of a potential soft landing for the economy, enhancing the likelihood of a Fed rate cut by September 18.

Additional economic data included:

- Jobless claims remained elevated but were largely in line with expectations.

- May housing starts fell month-over-month, missing consensus forecasts.

- June's Empire Manufacturing Index showed a mixed performance, with weaker employment but lower prices.

- The Philadelphia Fed Index declined unexpectedly.

- June's flash PMIs indicated solid growth and cooling inflation.

- May's existing home sales exceeded expectations.

Federal Reserve Commentary

Fed officials provided various insights, maintaining the narrative of potential rate cuts this year. Governor Kugler suggested cuts might be appropriate, emphasizing consumer-driven price competition. Fed's Williams reiterated that inflation is on track to return to the 2% target. Other Fed members shared mixed views, with some advocating caution and others anticipating rate cuts by year-end.

Bullish and Bearish Factors

Bullish factors included strong inflows into global equities, favorable seasonality, sustained AI growth, robust U.S. PMIs with cooling inflation, and successful bond auctions. Bearish elements comprised NVDA's streak ending, implications of weak retail sales on corporate earnings, declining homebuilder sentiment, and slowed industrial production in China.

Looking Ahead

Next week, key macro events will include:

- Tuesday: June Consumer Confidence, Richmond Fed Index, April Case-Shiller and FHFA Home Price Index.

- Wednesday: May New Home Sales, Building Permits.

- Thursday: Jobless Claims, Q1 GDP (final), May Durable Orders, Pending Home Sales.

- Friday: May PCE, June Michigan Sentiment, Chicago PMI.

S&P 500 Sector Performance

Outperformers:

- Consumer Discretionary: +2.50%

- Energy: +1.90%

- Financials: +1.70%

- Industrials: +1.55%

- Consumer Staples: +0.89%

- Communication Services: +0.77%

- Materials: +0.76%

Underperformers:

- Utilities: -0.77%

- Tech: -0.66%

- Real Estate: -0.32%

- Healthcare: +0.58%