Weekly Market Update

This week, the US equity markets presented a mixed performance, marking a significant shift in investment trends. We observed a pronounced rotation away from the previously dominant sectors—big tech, growth, and momentum—and into value stocks, cyclicals, and small-caps. The S&P 500 recorded its worst week since April 19th, marking only its third down week out of the past thirteen. However, the equal-weight S&P 500 managed to outperform the official index by approximately 190 basis points.

It should be noted that this week we began reducing our exposure to technology by temporarily increasing our cash position, adding to the equally weighted S&P 500 Index, and increasing our position in the Russell 2000 Small Caps Index.

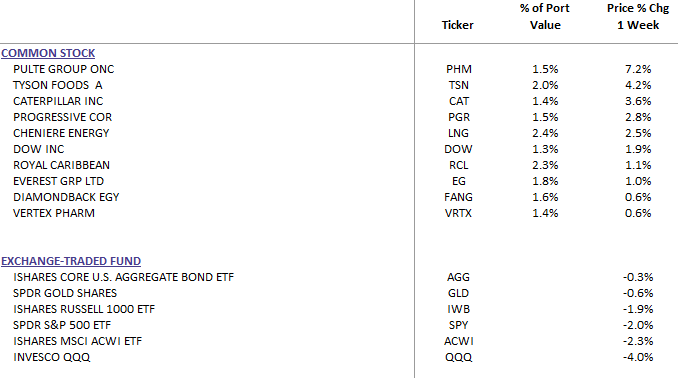

WealthTrust Long Term Growth Portfolio Weekly Top 10

Market Performance and Sector Rotation

The Nasdaq faced substantial pressure due to tech sector weakness, experiencing its first weekly loss since late May and only its second down week in the last thirteen. Conversely, the small-cap Russell 2000 demonstrated resilience, achieving gains in four out of the past five weeks. This included an impressive five-day rally through Tuesday, during which the index rose by 11.5%, reaching its highest close since December 2021, before pulling back from overbought levels.

Big tech experienced broad declines, with NVIDIA (NVDA) falling by 8.8% as a notable decliner. The semiconductor and software sectors also faced challenges, exacerbated by a global outage impacting CrowdStrike (CRWD), which saw a significant 17.9% drop. Other sectors facing headwinds included retail, autos and suppliers, apparel, casinos, large-cap pharmaceuticals, MedTech, beauty, copper/aluminum, and China tech. In contrast, sectors showing strength included homebuilders, regional banks, managed care (with UnitedHealth Group (UNH) up 10.5%), energy, rails, containerboard, media, REITs, machinery, and property and casualty insurance.

Economic and Treasury Movements

Treasuries weakened across the curve, with late-week yields reversing some of the earlier declines seen on Tuesday and Wednesday. The dollar strengthened after two weeks of declines, with the DXY rising by 0.3%. The yen exhibited midweek strength amid speculation of potential intervention. Gold prices fell slightly by 0.1%, following a sharp drop on Friday after reaching a fresh record high earlier in the week. Copper saw a significant decline, dropping 7.6% in its worst week since September 2022, driven by concerns over continued weak demand from China. Oil prices also fell, with WTI settling down by 4.3%.

Key Events and Economic Data

The week's market movements were influenced by continued rotation trends initiated by last week's cooler June CPI data, shifting focus from megacap tech, growth, and momentum sectors to small caps and value. This trend was underpinned by themes such as hopes for a soft landing, expectations of a Federal Reserve rate pivot, and the "Trump trade" driven by market anticipation of his potential victory in the upcoming November election.

June retail sales were flat against expectations for a decline, with May's figures revised upward, easing concerns about consumer resilience. Initial jobless claims ticked up, potentially due to seasonal and weather-related disruptions. The NY Fed Empire Manufacturing Survey showed slight improvement, while the Philadelphia Fed's Manufacturing Index reached its highest level since April. Housing data was mixed, with June housing starts and permits exceeding expectations, although homebuilder sentiment was weaker.

Fed Chair Powell's comments this week indicated increased confidence in inflation control, though without clear signals for future meetings. Governor Waller hinted at the possibility of a rate cut nearing, while Chicago's Goolsbee cautioned against maintaining rates steady for too long amid disinflation. Williams and Daly expressed optimism but remained cautious regarding future timelines.

Political Developments

Political developments included mounting pressure on President Biden to withdraw from the presidential race, with some reports suggesting he might make an announcement soon. Former President Trump officially accepted the Republican presidential nomination, outlining plans to cut corporate taxes and boost energy production in a Bloomberg interview. Additionally, there were reports of the US considering stringent trade restrictions as part of its ongoing chip crackdown against China.

Market Sentiment and Looking Ahead

Increased inflows into US equities suggest a possible FOMO (Fear of Missing Out) factor at play, as data strengthens the case for a soft landing. While the market may welcome potential Fed easing, concerns about the broader impact of a growth slowdown persist. Optimism about a pro-business Trump administration is tempered by worries over tariff-driven trade policies and potential repercussions from increased borrowing.

Upcoming Economic Data

Next week will feature key economic data, including existing-home sales (Tuesday), PMI composite and new-home sales (Wednesday), Q2 GDP, durable orders, and jobless claims (Thursday), and June core PCE (Friday). The Fed enters its blackout period ahead of the July 30-31 FOMC meeting, with no Fedspeak scheduled. Additionally, a significant number of Q2 earnings reports are expected, with notable companies including Verizon, Coca-Cola, Lockheed Martin, UPS, Google, Tesla, Visa, AT&T, and Thermo Fisher Scientific.

Sector Performance

Sector performance this week was varied:

- Outperformers: Energy (+2.02%), Real Estate (+1.30%), Financials (+1.18%), Consumer Staples (+0.90%), Industrials (+0.56%), Healthcare (-0.33%), Materials (-0.46%), Utilities (-1.56%)

- Underperformers: Technology (-5.14%), Communication Services (-2.88%), Consumer Discretionary (-2.68%)

Thank you for your continued trust. We will continue to monitor these developments and adjust our strategies accordingly to navigate the evolving market landscape.