Weekly Commentary for the week ending November 16, 2024

Market Week in Review: Balancing Optimism with Growing Uncertainties

The U.S. equity markets experienced a pullback this week, with major indices retreating from last week’s record highs. The S&P 500 and Nasdaq posted losses, while the Russell 2000 underperformed, erasing almost half of its prior week's impressive 8.6% gain. The sell-off extended across various sectors, underscoring a more defensive market tone.

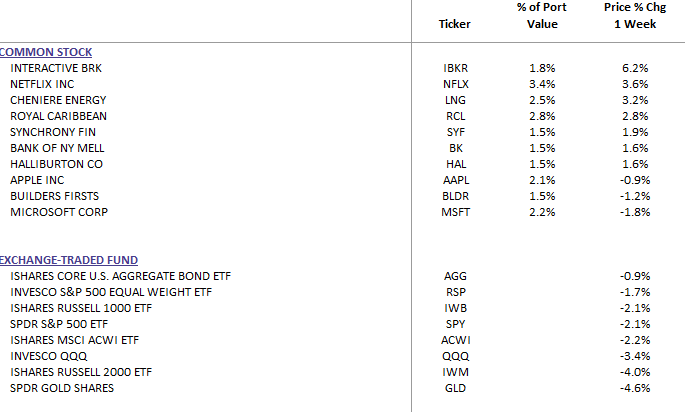

WealthTrust Long Term Growth Portfolio Weekly Top 10

Sector Winners and Losers

Big Tech had a mixed week, with Netflix (+3.6%) providing a bright spot, while Meta (-2.4%) and Nvidia (-3.8%) lagged. Healthcare took a significant hit, led by Amgen (-12.9%) and AbbVie (-17.3%), alongside other lagging groups like semiconductors (-8.6%), mining stocks, and homebuilders. Conversely, financials and household staples showed resilience, with standout performances in entertainment stocks (Disney +16.2%), logistics, and refining.

Mixed Signals from Economic Data

The week’s economic releases painted a complex picture for investors. October’s CPI came in line with expectations, showing no signs of re-accelerating inflation but also slower disinflationary progress. The retail sales report was a highlight, with upward revisions to September’s numbers signaling consumer resilience in categories like electronics, vehicles, and restaurants. However, weaker furniture and department store sales hinted at uneven demand across sectors.

Other economic indicators, such as October core PPI and initial jobless claims, were mixed. The Empire State Manufacturing Index showed surprising strength, but hotter-than-expected import and export prices added to inflationary concerns.

Fed’s Cautious Optimism

Federal Reserve Chair Jerome Powell emphasized a cautious approach, noting no urgency to cut rates. This sentiment was echoed by several Fed officials, who reiterated the need for patience amidst a soft-landing narrative. While markets trimmed the odds of a December rate cut to 60% following Powell's remarks, uncertainty around monetary policy persists.

Market Drivers: Bullish vs. Bearish Forces

On the bearish side, rising bond yields, dollar strength, and regulatory concerns weighed on sentiment. Investors also grappled with potential macroeconomic disruptions tied to geopolitical tensions and evolving policy shifts under a new administration.

However, bullish drivers like strong equity inflows, stable CPI data, and retail sales resilience kept optimism alive. Positive corporate developments, such as Disney’s robust forward guidance and Shopify’s (+24.5%) strong Q4 outlook, further bolstered sentiment.

Corporate Highlights

Earnings season, while winding down, delivered some notable reports:

- Winners: Shopify (+24.5%) soared on better-than-expected Q4 guidance, while Tyson Foods (+7.9%) impressed with margin expansion.

- Laggers: Cisco (-1.0%) fell despite strong AI order strength due to public sector weakness, and Advanced Micro Devices (-12.0%) disappointed on softer guidance.

- Special Mention: Disney (+16.2%) surged on optimistic FY25 and FY26 projections.

Elsewhere, regulatory developments weighed on Rivian (-5.0%) amid talks of EV tax credit eliminations, while Spirit Airlines (-60.0%) filed for bankruptcy, highlighting challenges in the airline sector.

Looking Ahead

Next week, the spotlight will be on a mix of earnings reports and macroeconomic events:

- Earnings Highlights: Walmart (Tuesday AM), Nvidia (Wednesday PM), and Deere & Co (Thursday AM).

- Macro Events: October Housing Starts (Tuesday), Jobless Claims (Thursday), and November PMI and Consumer Sentiment (Friday).

Investment Takeaway

This week underscored the need for a balanced approach to portfolio management. While consumer resilience and select corporate strength support optimism, rising bond yields and geopolitical uncertainty require careful navigation. For investors, focusing on sectors with strong fundamentals and remaining vigilant to macro shifts will be key to navigating this evolving market environment.