Weekly Commentary for the week ending December 28, 2024

Market Commentary: Year-End Dynamics in Focus

Stocks Advance Despite Mixed Economic Signals

U.S. equities closed the holiday-shortened week with moderate gains, driven early on by large-cap growth stocks. The Nasdaq Composite led the charge, while the Russell 1000 Growth Index outpaced its value counterpart through midweek. However, post-Christmas trading saw a partial reversal as most indexes gave back some of their earlier advances.

Consumer Confidence and Manufacturing Decline

Economic data painted a mixed picture. The Conference Board’s Consumer Confidence Index fell sharply in December to 104.7, reflecting diminished optimism about current and future economic conditions. Durable goods orders also disappointed, declining 1.1% in November due to weaker commercial aircraft and defense spending. Meanwhile, new home sales came in slightly below expectations but improved from the prior month, which had been affected by severe weather in the Southeast.

Labor Market Sends Mixed Signals

Initial jobless claims edged lower to 219,000, marking their lowest level since mid-November. However, continuing claims rose to 1.91 million—the highest since 2021—indicating longer job searches for displaced workers.

Treasury Yields Rise Amid Light Trading

U.S. Treasury yields climbed, with the 10-year note touching 4.641% on Thursday. High-yield bonds posted modest gains, supported by stable macroeconomic conditions and muted trading activity. With no major deals announced, bond markets are expected to remain quiet through year-end.

Strategy changes that we implemented this week: With the dollar strengthening and longer-term yields rising, we reduced our position in Gold and Silver. In our balanced strategies, we exchanged our longer-term treasuries for short term treasuries and floating rate bonds.

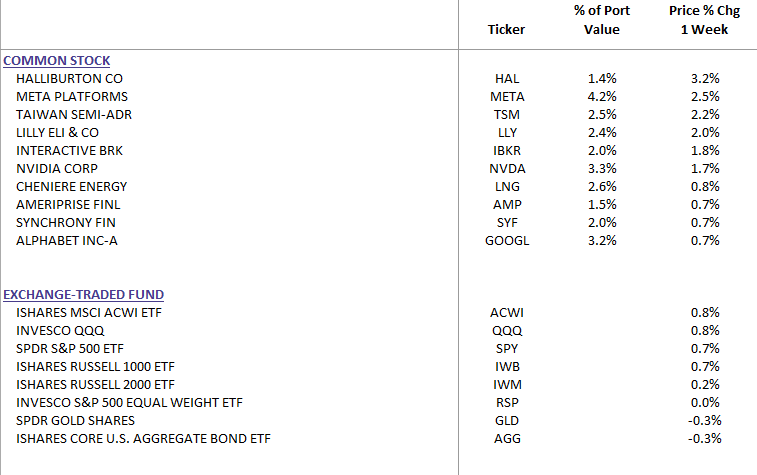

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

Weekly Market Recap: Positive Momentum Amid Year-End Slowdown

As we approach the end of the year, major U.S. equity indices closed slightly higher this week despite thin trading volumes due to the midweek Christmas holiday. The Dow rose 0.35%, the S&P 500 climbed 0.67%, the Nasdaq added 0.76%, and the Russell 2000 edged up by 0.10%, reflecting modest gains across the board.

Market Highlights

- Technology Leads Gains:

- Big tech stocks showed resilience, with Tesla (TSLA) posting a 2.5% weekly gain despite a sharp 5% drop on Friday.

Other sectors, including energy, managed care, airlines, rails, and biotech, also saw notable gains.

- Sector Underperformance:

- Weakness was observed in software, media, homebuilders, discount retail, hospitals, and cruise lines.

- Treasuries and Dollar Movement:

- The Treasury market saw weaker performance, and the 2/10 spread reached its most positive level since June 2022.

- The U.S. dollar strengthened against the yen but remained stable versus the euro and sterling. The DXY index rose 0.4%, marking gains in 12 of the past 13 weeks.

- Commodities:

- WTI crude oil advanced 1.6%, while gold fell 0.5%, continuing its recent downtrend.

Key Market Drivers

The holiday-shortened week offered few major developments but featured notable volatility within the tech sector. Tuesday saw gains driven by a belief that concerns over a hawkish Federal Reserve may have been overdone. However, this optimism was followed by a tech-led selloff on Friday, driven partly by rising Treasury yields, including an 8-basis-point increase in the 30-year bond yield.

On the economic front, the data presented a mixed picture:

- Consumer Confidence: December figures missed expectations due to declines in present and future outlooks, although labor market sentiment improved.

- Housing Market: November new-home sales rose month-over-month but fell short of forecasts.

- Durable Goods Orders: Headline orders were light, but core capital goods orders beat estimates.

Jobless Claims: Initial claims decreased week-over-week, but continuing claims reached their highest level since November 2021.

Corporate Updates

Corporate news was limited, though several significant developments stood out:

- Rumble (RUM) soared 112% after securing a $775M strategic investment from Tether.

- Honda (HMC) and Nissan (NSANY) confirmed merger talks, with a potential deal expected by mid-2025.

- Xerox (XRX) announced plans to acquire Lexmark for ~$1.5B.

- Nordstrom (JWN) is set to go private in a $6.25B all-cash deal with the Nordstrom family and Liverpool.

The Week Ahead

Next week will provide additional economic insights with reports on:

- November pending home sales (Monday),

- FHFA and Case-Shiller home prices (Tuesday),

- Initial jobless claims and construction spending (Thursday),

- December ISM Manufacturing Index (Friday).

No major earnings reports or Federal Reserve speeches are expected, and markets will be closed on Wednesday for New Year’s Day.

Looking Ahead

As markets wrap up 2024, cautious optimism prevails amid lingering signs of economic strain. Investors are closely watching labor trends and inflation data as indicators of what lies ahead in 2025.