Weekly Commentary for the week ending January 18, 2025

Did the Swing on Interest Rates Go Too Far?

Last week’s spike in the 10-year Treasury yield to 4.8%, a 14-month high, raised questions about whether the bond market has overreacted. This week's encouraging inflation data, including a decline in core CPI to 3.2%, provided a glimmer of relief, leading yields to retreat. This dynamic underscores the delicate balance between inflation, economic growth, and monetary policy.

Despite strong economic fundamentals, the bond sell-off may have overshot. Without the Fed signaling a return to tightening, it seems unlikely yields will sustainably exceed the prior peak near 5%. Stabilizing yields could pave the way for a revival in value and cyclical stocks, particularly if earnings continue to demonstrate resilience.

While high rates have pressured valuations, the broader market narrative remains intact. Investors may have shifted from overconfidence in rate cuts to underestimating the Fed’s flexibility. If stability returns to yields, this recalibration could fuel the next leg higher for equities, reaffirming the strength of the current bull market.

Market Update: A Strong Week for US Equities Amid Positive Earnings and Disinflation Trends

This past week was marked by robust performance across major US equity indices, with the S&P 500 and Nasdaq both posting gains after a rocky start to the year. Here’s a breakdown of the critical developments:

Equity Market Highlights

- The S&P 500 Equal-Weight Index (RSP) outperformed the official index, rising 3.9%, signaling broad market strength.

- Big Tech saw solid gains, highlighted by Tesla's (TSLA) impressive +8.1% rally.

- Strong-performing sectors included financials, energy, materials, industrials, and utilities, with notable strength in banks, asset managers, and homebuilders.

- Conversely, defensive and growth-oriented sectors like healthcare, consumer staples, and communication services lagged.

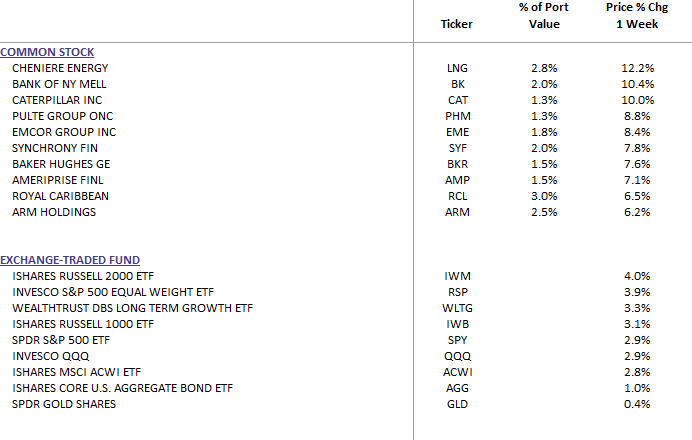

WealthTrust Long Term Growth Portfolio Weekly Top 10

Macroeconomic Trends Driving Markets

The December Consumer Price Index (CPI) report emerged as the week's focal point. While headline inflation was slightly above consensus due to food and energy price increases, core CPI came in lighter than expected, signaling continued disinflation. Combined with a favorable Producer Price Index (PPI) report, these figures eased inflationary concerns, helping to stabilize Treasury yields after a recent uptick.

Treasury yields reflected this dynamic, with the 30-year yield touching 5% early in the week before retreating. Fed commentary also leaned dovish, with officials expressing cautious optimism about inflationary trends and the potential for rate cuts later in 2025, contingent on supportive data.

Corporate Earnings Spotlight

Financials took center stage as major banks reported Q4 results:

- JPMorgan Chase (JPM): +8.2% on a trading-driven beat and optimistic net interest income (NII) guidance.

- Wells Fargo (WFC): +10.2%, supported by solid NII despite mixed results.

- Citigroup (C): +12.0%, with a $20B buyback announcement amplifying the market's positive reaction.

Elsewhere, United Rentals (URI) jumped +14.9% following an acquisition announcement, and Intel (INTC) rose +12.2% on M&A speculation. These performances reflect the market's broader optimism about corporate earnings resilience in 2025.

Economic and Geopolitical Outlook

While inflation trends are improving, uncertainties linger, including fiscal policy clarity and geopolitical tensions. Investors continue to monitor tariff dynamics, trade negotiations, and upcoming Q4 earnings reports for further guidance.

Sector Performance Review

Outperformers this week included energy (+6.14%), financials (+6.10%), and materials (+6.01%). On the other hand, healthcare (+0.30%) and consumer staples (+1.26%) posted more modest gains.

Looking Ahead

Next week’s focus will shift to a busier earnings calendar, with 43 S&P 500 companies reporting, and economic updates including PMI composite data and housing market figures. Additionally, the inauguration of President Trump may bring policy clarity in areas like tariffs, energy, and deregulation.

Final Thoughts

This week’s market performance underscores the importance of diversification and sector positioning. As disinflation continues and corporate earnings surprise to the upside, there are opportunities to capture value across sectors. However, vigilance is key, as fiscal policy uncertainties and geopolitical risks could introduce volatility.

We remain committed to navigating these dynamics strategically, focusing on preserving capital and delivering consistent returns.