Monthly Commentary for January 2025

January Market Recap: U.S. Equities Rally Amid Economic and Policy Uncertainty

Supported by a strong economy and a resilient labor market, the Federal Reserve has decided to hold off on lowering interest rates this week.

- The U.S. economy continues to demonstrate stability, growing at a 2.3% annualized rate in the fourth quarter.

- Earnings reports from four of the Magnificent 7 companies this week have further strengthened an already impressive corporate earnings season.

- As anticipated, the Fed maintained its current interest rates, citing core PCE inflation remaining above the 2% target and a deceleration in disinflation.

Economic momentum remains evident, as fourth-quarter GDP data reaffirms steady growth at 2.3%, slightly below the forecasted 2.4%. Consumer spending, the primary driver of expansion, rose at a 4.2% annualized rate—its highest since early 2023. While downturns in investment and exports dampened overall growth, real GDP expanded by 2.8% in 2024, compared to 2.9% in 2023.

With the unemployment rate at 4.1% and job openings surpassing unemployment levels, the labor market continues to support wage growth above inflation, providing positive real wages. Additionally, the U.S. manufacturing sector, which faced contraction over the past two years, has shown signs of stabilization. A strong labor market and resilient consumer spending should sustain economic momentum moving forward.

While growth may cool in early 2025 as lower-income consumers scale back discretionary spending, recession risks remain low. Economic growth could reaccelerate in the latter half of the year, driven by potential Fed rate cuts and pro-growth policies such as deregulation and tax incentives.

Market participants will keep a close watch on upcoming economic indicators, including labor market data and consumer sentiment reports. Corporate earnings will also be a key focus, as investors gauge sectoral growth trajectories and forward guidance. In the near term, market volatility may persist as traders navigate an evolving economic landscape shaped by shifting monetary policies and global developments.

The U.S. equity market kicked off the new year with strength, recovering from a weak December. The S&P 500 reached new record highs, boosted by broad-based gains, with the equal-weighted index outperforming the official index by over 70 basis points. Small-cap stocks also had a strong month, with the Russell 2000 rebounding from an 8% loss in December. Meanwhile, the bond market firmed, reflecting some yield curve steepening, while the U.S. dollar index declined slightly, supported by notable strength in the yen. Commodities were robust, with gold climbing 7.1% to record highs, Bitcoin futures gaining 9.3%, and WTI crude oil rising 1.1% amid concerns over potential supply disruptions due to sanctions on Russian oil and proposed tariffs on Canadian oil.

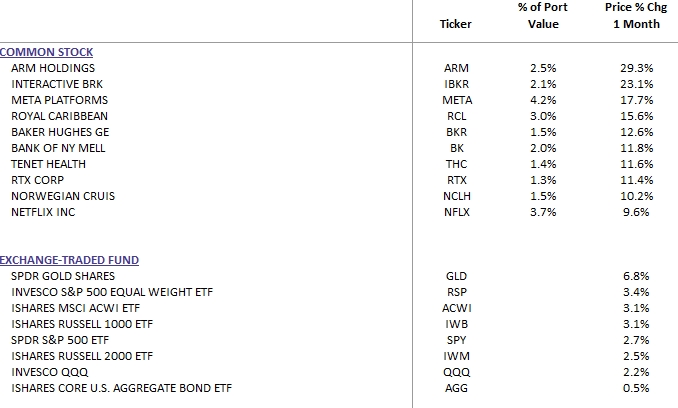

WealthTrust Long Term Growth Portfolio Monthly Top 10:

Washington Policy Developments and Market Reactions

Political developments dominated market headlines in January, as President Trump began his new term. Markets continued to benefit from the interplay of investor optimism, deregulation dynamics, and favorable late-January seasonality. Strong corporate buybacks and a slight reprieve in interest rates also contributed to market gains. However, policy uncertainty remained, particularly around tariffs. While no immediate tariff implementations followed Trump's inauguration, threats of significant trade restrictions persisted. Trump initially proposed a 25% tariff on Colombia over a migrant dispute but backed down after diplomatic negotiations. However, reports suggested that his administration was considering 25% tariffs on Mexico and Canada as soon as February 1st, with an additional 10% tariff on China. As of this writing, these will take affect today, February 1st., 2025. Further tariff discussions included potential duties on semiconductors, steel, aluminum, and copper, with Trump stating that final rates could be much higher than the 2.5% initially proposed by Treasury Secretary Bessent.

On the fiscal front, uncertainty loomed over how to finance Trump’s tax cuts, with GOP factions divided between deficit reduction and concerns about economic consequences for constituents.

Sector Trends and Market Themes

The AI-driven growth narrative took a hit in January following concerns over China’s low-cost DeepSeek AI model, which led to a selloff in AI-linked stocks. Investors reassessed the long-term profitability of U.S. AI companies, with scrutiny on spending patterns, pricing power, and America’s competitive edge in artificial intelligence. Meanwhile, concerns about extended valuations in Big Tech resurfaced, especially as analysts began questioning the high capital expenditures associated with AI expansion.

Pharmaceuticals also faced headwinds, particularly in the GLP-1 drug space, after Eli Lilly lowered its guidance due to softer-than-expected sales of Mounjaro and Zepbound. Despite these sector-specific challenges, broader economic indicators remained favorable, with a resilient labor market and consumer strength. Goldman Sachs remained bullish on U.S. growth, forecasting 2.4% GDP expansion for 2025, exceeding the 2.0% consensus estimate.

Earnings Season Highlights

Corporate earnings showed resilience, with 77% of S&P 500 companies reporting positive earnings surprises and 63% beating revenue expectations. However, performance across sectors varied:

- Winners: Netflix (+9.6%) exceeded expectations across key metrics, adding a record 19 million paid subscribers. Meta (+17.7%) benefited from AI-driven product tailwinds. The banking sector surged, with JPMorgan (+11.5%) and Wells Fargo (+12.2%) benefiting from deregulation. Financials also saw a boost, with Discover (+16.0%) and Capital One (+14.2%) posting strong results. Healthcare and managed care stocks, such as Humana (+15.6%), also outperformed.

- Mixed Performers: Tesla (+0.2%) reported weak gross margins, while Apple (-5.7%) delivered an EPS beat but disappointed on iPhone and China sales. Microsoft (-6.5%) lagged due to slowing Azure growth.

- Underperformers: Semiconductor stocks suffered, with Nvidia (-15.8%) and Intel (-6.2%) facing headwinds. Consumer staples struggled, as Hershey (-11.8%) and Constellation Brands (-18.2%) saw declines. Apparel retailers, logistics companies, and insurance firms were also among the laggards.

Federal Reserve and Interest Rate Outlook

The Federal Reserve held rates steady at 4.25-4.50% during its January FOMC meeting, as expected. The policy statement carried a slightly hawkish tone, but Chair Jerome Powell adopted a more dovish stance in his press conference, emphasizing that the Fed was in no rush to cut rates. Recent inflation data showed continued progress toward the Fed’s 2% target, with easing shelter inflation providing additional support for a rate pause. While analysts largely expect the Fed to hold rates for an extended period, some believe that continued moderation in inflation could lead to rate cuts by midyear.

The December FOMC minutes highlighted concerns about upside risks to inflation, though Fed Governor Christopher Waller suggested that multiple rate cuts may still be warranted. Meanwhile, international central banks saw policy shifts, with the European Central Bank cutting rates by 25 basis points to 2.75%, while the Bank of Japan raised its key interest rate to 0.5% from 0.25% in response to steady inflation.

Economic Data Review

- Inflation: December core CPI slightly exceeded expectations, while headline CPI came in below forecasts, reinforcing the trend of slowing inflation.

- Labor Market: December nonfarm payrolls surged by 256,000, well above the 150,000-160,000 consensus, pushing the unemployment rate down to 4.1%.

- Consumer Spending: December retail sales slightly missed expectations, though the control group component outperformed. Tariffs were flagged as a potential headwind for consumer spending.

- Manufacturing: The December ISM Manufacturing Index beat expectations, though employment weakened while prices increased.

Conclusion: Navigating Uncertainty Amidst Strength

January saw a strong market driven by optimism around deregulation, solid corporate buybacks, and resilient economic indicators. However, investors should remain cautious as uncertainties around trade policy, AI profitability, and monetary policy direction persist. While earnings remain robust, sector-specific challenges highlight the importance of strategic positioning in a complex market environment. Careful portfolio diversification and a keen eye on macroeconomic trends will be key to navigating the months ahead.