Weekly Commentary for the week ending April 05, 2025

Equities Navigate Trump’s Bold Tariff Vision Amid Growth Opportunities

U.S. equities faced a dynamic week of recalibration as markets absorbed President Donald Trump’s ambitious “Liberation Day” tariff plan—a transformative move aimed at reshaping global trade. The S&P 500 experienced a sharp two-day adjustment, declining 10.5% (-4.8% Thursday, -6.0% Friday), marking its most active week since March 2020. The Nasdaq and Russell 2000 entered bear market territory, while the volatility index (VIX) surged to 43—its highest close since April 2020—signaling a vibrant opportunity potential for nimble investors.

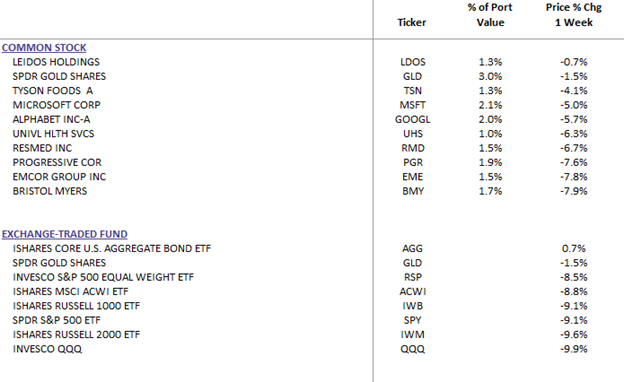

In our Individual Equity Strategies, the 25% allocation to short term treasuries and Gold(GLD) has assisted with our year-to-date outperformance verses the S&P 500, Top 100 Nasdaq(QQQ), and Russell 1000 Growth Indexes. More importantly, it gives us liquidity to purchase the oversold investment opportunities which should arise as a result of the aforementioned volatility.

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

Midweek, Trump unveiled a bold tariff strategy: a 10% baseline on all imports, with targeted levies like 34% on China, 32% on Taiwan, 46% on Vietnam, and 20% on the EU, while offering Canada and Mexico a 25% rate with USMCA exemptions. Far from a setback, this framework positions the U.S. as a negotiating powerhouse, with Trump hinting at flexibility for nations ready to strike “phenomenal” deals. China’s swift 34% counter-tariff on U.S. goods only underscores the high-stakes chess match now underway—a chance for markets to adapt and innovate.

Market Resilience Shines Through

Even the “Magnificent 7” tech titans faced a healthy reset, with NVIDIA (-14%) and Meta (-12.5%) leading a broader tech rebalancing. Semiconductors (SOX -16%) and banks (KRX -12.2%, BKX -13.8%) saw profit-taking, while energy (-14.1%), financials (-10.3%), and industrials (-9.4%) adjusted to the new trade landscape. Consumer discretionary stars like Nike (-9.5%) and Lululemon (-10%) took a breather, and housing-related retail—RH (-38.4%), Wayfair (-23%)—offered bargain hunters a potential entry point.

Commodities joined the action, with WTI crude dropping 10.6%—its most significant move since March 2023—after OPEC+ boldly tripled its May output plans, signaling confidence in future demand. Gold (-1.5%) paused after hitting a record high, while Bitcoin futures held steady (+0.1%), showcasing digital assets’ growing stability.

Defensive sectors emerged as unsung heroes, with healthcare, managed care, grocers, waste management, telecom, insurance, and off-price retail proving their mettle as reliable anchors amid the storm.

Treasuries Shine, Fed Signals Flexibility

A surge in safety-seeking capital drove Treasury yields lower, with the 2-year and 10-year each shedding about 25 basis points. The 2Y briefly dipped below 3.5%—a level unseen since March 2023—and the 10Y hit 3.9%, rewarding bondholders with a timely rally. Fed Chair Jerome Powell, in a measured tone, acknowledged tariffs might lift inflation but stressed adaptability, keeping the Fed’s options open. Markets responded optimistically, boosting May rate cut odds to 31% (from 18%) and pricing in 100 basis points of cuts by year-end—up from 65 bps—reflecting confidence in monetary support.

Growth Horizon: A New Chapter

Wall Street firms adjusted their S&P 500 targets with a pragmatic eye: Goldman Sachs refined its forecast to 5,700 from 6,200, and RBC to 5,500, spotlighting undervalued opportunities amid the reset. Economists see tariffs potentially adding 1–1.5% to PCE inflation—a catalyst for innovation—while UBS projects core PCE peaking at 4.5% by mid-2026, offering a clear runway for strategic planning.

Economic Data: Strength Beneath the Surface

Economic signals were a mixed bag but brimming with potential. March nonfarm payrolls soared to 228K (far exceeding 120–140K estimates), despite a 48K revision to prior months. Hourly earnings rose a modest 3.8% y/y—the coolest since July—hinting at easing wage pressures. JOLTS job openings hit a low since December 2024, yet Challenger job cuts spiked to 275K, primarily the result of DOGE actions, suggesting a labor market ripe for realignment. Manufacturing data showed contraction, but the broader narrative remained one of resilience.

Corporate Highlights: Innovation Persists

AI enthusiasm tempered as Microsoft (-5%) scaled back data center plans, yet the sector’s long-term promise endures. Tesla (-9.2%) faced a Q1 delivery miss but remains a trailblazer, while RH (-38.4%) signaled consumer caution—a chance for savvy investors? Intel (-12.6%) and TSMC (-11.2%) forged a promising JV, with TSMC eyeing a 20% stake in Intel’s chipmaking arm. Automakers like GM (-5.4%) and Stellantis (-14.2%) adapted with production tweaks, showcasing agility.

Looking Ahead: Earnings and Optimism

Next week’s earnings season promises fresh catalysts, with Delta (Apr 9), CarMax (Apr 10), and JPMorgan (Apr 11) headlining. Economic highlights—March CPI (Apr 10), PPI, and Michigan Sentiment (Apr 11)—will offer clarity, with sentiment potentially dipping but setting the stage for a rebound. Treasury auctions and FOMC minutes round out a packed slate.

Conclusion:

Market ups and downs are creating new possibilities. Trump’s tariff plan has everyone talking about trade, and with earnings season coming up, exciting changes are ahead. Smart investors who act now could turn this shaky time into big wins. The mix of new policies, market shifts, and upcoming reports sets the stage for a potentially rewarding future, ready for those who participate intelligently.